Key benefits of AI for CFOs—and how accountants can help unlock them

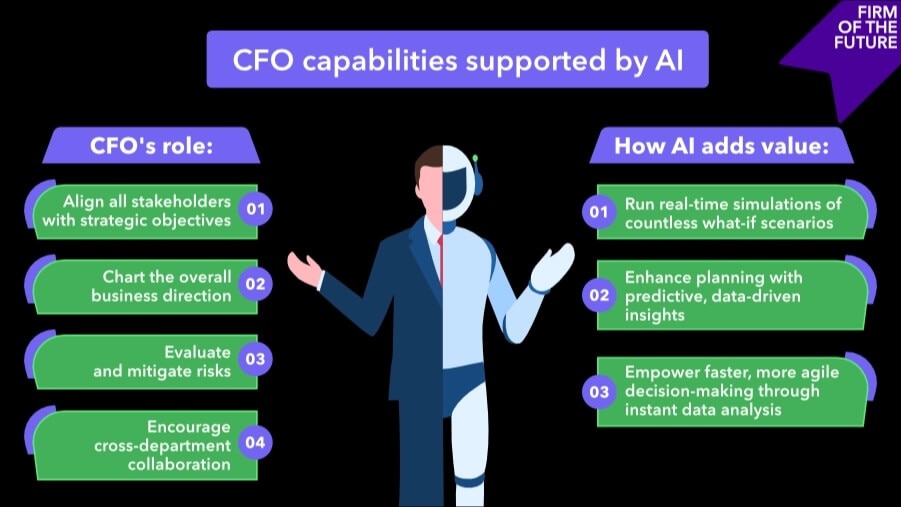

AI has huge potential to make finance teams faster and sharper. But it’s not just about picking the right tools; it’s about making sure those tools actually work for the business. CFOs need partners who understand how the tech works and how it fits into the bigger financial picture.

For accountants, especially in CAS roles, this means helping CFOs use AI in ways that support their goals, keep things running smoothly, and lead to better decisions.

Data-driven insights

AI systems can quickly analyze large volumes of financial data and surface trends that might take days to uncover manually. CFOs can use this intelligence to guide decisions around budgeting, pricing, and investment.

Accountant’s role: Ensure clean, structured data feeds into AI systems, improving the quality of outputs and the CFO’s confidence in the insights they receive.

Automation of repetitive tasks

Tasks such as reconciling accounts, generating reports, or even handling basic audit procedures can now be automated using AI-driven tools.

Accountant’s role: Help CFOs evaluate where automation can save time and where human oversight is still essential. Your nuanced understanding of financial workflows can prevent over-automation risks.

Predictive analytics

AI enables CFOs to model future scenarios with greater accuracy by pulling from historical data and current market conditions.

Accountant’s role: Translate predictions into actionable financial planning recommendations. Your interpretation of these outputs often shapes the CFO’s ability to make confident decisions.

Improved accuracy

By minimizing manual input and flagging anomalies in real time, AI reduces the risk of human error in reporting.

Accountant’s role: Ensure ongoing monitoring and validation of AI outputs, especially during the initial stages of implementation.

Scalability

As businesses grow, finance functions often struggle to keep pace. AI allows finance teams to handle increased complexity without having to add headcount.

Accountant’s role: Help assess whether current systems can scale, recommend AI-driven tools that handle growing data volumes, and build financial workflows that stay accurate and efficient as the business adds complexity.