Migrate clients and save 80% on QuickBooks Online Payroll for 2 years

In a nutshell: For a limited time, accountants who use QuickBooks Desktop Enhanced Payroll for Accountants and migrate their clients to QuickBooks Online Payroll will receive 80% off QuickBooks Online Payroll monthly subscription and per-employee fees for 2 years. To take advantage of this discount, an accountant must migrate a minimum of 5 clients. Offer ends 7/31/24.

Accountants can get ProAdvisor Preferred Pricing of 30% off QuickBooks Online for the life of the subscription.*

In addition to these discounts, here are more great reasons to switch to QuickBooks Online and Online Payroll:

- QuickBooks Online and Online Payroll work seamlessly together to help your clients manage their business and pay their team in one place, under one sign-in.**

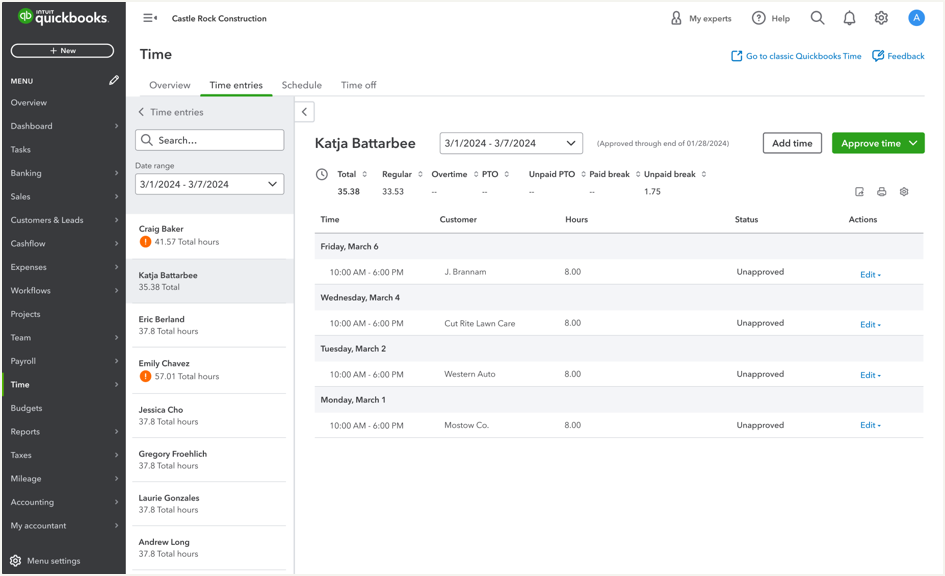

- Time tracking that syncs automatically with Payroll, so your clients can easily manage their team and approve payroll when they’re ready.**

- Multiple people can access QuickBooks Online from any device, so your clients’ teams can collaborate remotely anytime.**

- We’ll automatically calculate, file, and pay your clients’ federal, state, and local payroll taxes—accuracy, guaranteed.**

- Your clients will get automatic updates with the latest security capabilities.

- Migrate key accounting and payroll data from desktop to the cloud with confidence, and get a free migration and personalized setup session.*

For more information, call 844-333-1799 today.

Important pricing details and disclaimers

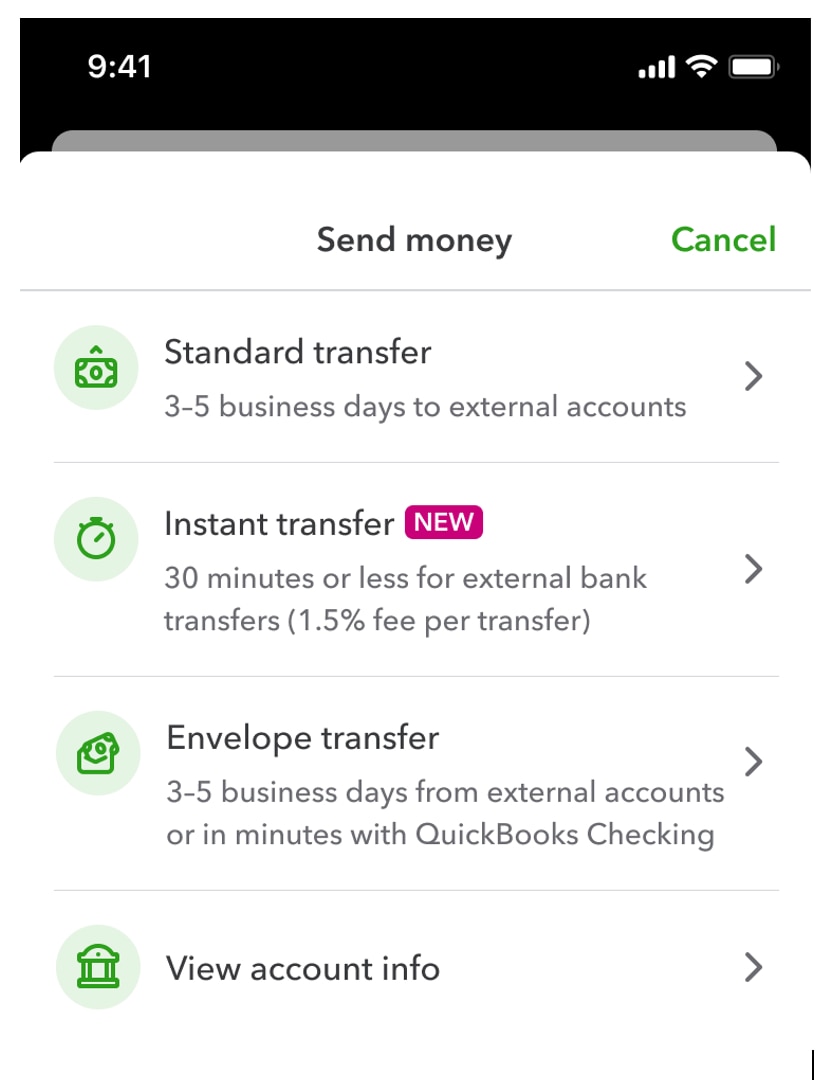

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services, subject to eligibility criteria, credit and application approval. For more information about Intuit Payments Inc.’s money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

Guarantee

Accuracy Guaranteed available with QuickBooks Online Payroll Core, Premium, & Elite: We assume responsibility for federal and state payroll filings and payments directly from your account(s) based on the data you supply. As long as the information you provide us is correct and on time, and you have sufficient funds in your account, we’ll file your tax forms and payments accurately and on time or we’ll pay the resulting payroll tax penalties. Guarantee terms and conditions are subject to change at any time without notice.

*Offer terms

80% off the monthly price for QuickBooks Online Payroll Core, Premium, or Elite (“Payroll”) is for the first 24 months of service, starting from the date of enrollment, followed by the then-current monthly list price. Your account will automatically be charged on a monthly basis until you cancel. Each employee is an additional $6/month for Core, $8/month for Premium, and $10/month for Elite. Contractor payments via direct deposit are $6/month for Core, $8/month for Premium, and $10/month for Elite. The service includes 1 state tax filing. If you file taxes in more than one state, each additional state is $12/month for only Core and Premium. The discounts do not apply to additional employees and state tax filing fees. If you add or remove services, your service fees will be adjusted accordingly. If you upgrade or downgrade to a different subscription, the price will change to the then current list price for such relevant subscription. Sales tax may be applied where applicable. To be eligible for this offer you must be a new Payroll customer and sign up for the monthly plan using the `Buy Now '' option. Offer available for a limited time only. To cancel your subscription at any time go to Account & Settings in QuickBooks and select “Cancel.” Your Payroll cancellation will become effective at the end of the monthly billing period. You will not receive a prorated refund; your access and subscription benefits will continue for the remainder of the billing period. Offer cannot be combined with any other QuickBooks offer. Terms, conditions, pricing, special features, and service and support options subject to change without notice. Offer ends 7/31/24.

*ProAdvisor Preferred Pricing – ProAdvisor Discount

30% off subscription and 15% off transaction fees – ongoing

30% off the then-current list price of QuickBooks Online Bill Pay and 15% off the then-current list price per transaction.

Offer terms: Your account will automatically be charged on a monthly basis until you cancel. If you add or remove services, your service fees will be adjusted accordingly. If you upgrade or downgrade to a different subscription, the price will change to the then current list price for such relevant subscription. Sales tax may be applied where applicable. This offer can't be combined with any other QuickBooks offers. Offer only available for a limited time and to new QuickBooks customers.

Cancellation: To cancel your QuickBooks Products subscription at any time go to Account & Settings in QuickBooks and select “Cancel.” Your cancellation will become effective at the end of the monthly billing period. You will not receive a pro-rated refund; your access and subscription benefits will continue for the remainder of the billing period.

Free Assisted Migration and personalized setup from QuickBooks Desktop Pro, Premier, Mac, or Plus (“Desktop”) to QuickBooks Online Simple Start, Essentials, Plus or Advanced (“QuickBooks Online”), or QuickBooks Desktop Payroll, Payments, or Time to QuickBooks Online Payroll, Payments, or Time is available to customers who sign up for Assisted Migration or personalized setup to QuickBooks Online and is subject to capacity. The Assisted Migration offer is eligible to Desktop customers that are migrating their data and setting up QuickBooks Online. The personalized setup offer is eligible to Desktop customers that are migrating their data, as well as those customers who elect not to migrate their data, who are starting new QuickBooks Online accounts, and setting up QuickBooks Online. Personalized setup is limited to a 1-hour session with a customer success product expert. Intuit reserves the right to limit the number of sessions and the length and scope of each session. Assisted migration results may vary based on business complexity and file size. Terms and conditions, features, support, pricing, and service options are subject to change without notice.

**Product Information

Time tracking with QuickBooks Time is included in QuickBooks Online Payroll Premium and Elite only.

QuickBooks Online usage limits. QuickBooks Online Advanced includes an unlimited chart of accounts entries. QuickBooks Online Simple Start, Essentials and plus allow up to 250 chart of accounts entries. QuickBooks Online Advanced includes unlimited classes and locations. QuickBooks Plus includes up to 40 combined classes and locations. Classes and locations are not available in Simple STart and Essentials.

**Features

QuickBooks Time: Time tracking included in the QuickBooks Online Payroll Premium and Elite subscription services. Features vary. The QuickBooks Time mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Multiple users: User numbers vary based on plan type.

From any device anytime: Requires a computer or a device with a supported internet browser and an internet connection (a high-speed connection is recommended).

Automated tax payments and filings: Automated tax payments and filing available for state and federal taxes. Enrollment in e-services is required for tax payments and filings only. Automated tax payments and filings for local taxes available in QuickBooks Online Payroll Premium and Elite only.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.