With autumn in full swing, did you know Nov. 4 is Book Lovers Day? We assume they mean the “bookkeeping” kind because we love our bookkeepers. Whether you’re a bookkeeper or accountant, here are our November QuickBooks updates.

Share QuickBooks updates with your clients: Send them this link for QuickBooks innovations relevant to business owners and admins.

In the Know Webinar

Register today for the next In The Know Webinar on Thursday, Nov. 16 at 11:00 AM PT, a monthly webinar to learn more about the latest and greatest product feature updates. This month, join us to learn about the new QuickBooks Ledger solution for year-end, tax-only, or low-transaction clients, as well as the reimagined ProAdvisor Program.

Your Feedback in Action

This is a regular series where we share relevant product improvements specifically driven by feedback from accountants. See our summary article for the latest updates.

What’s New in November

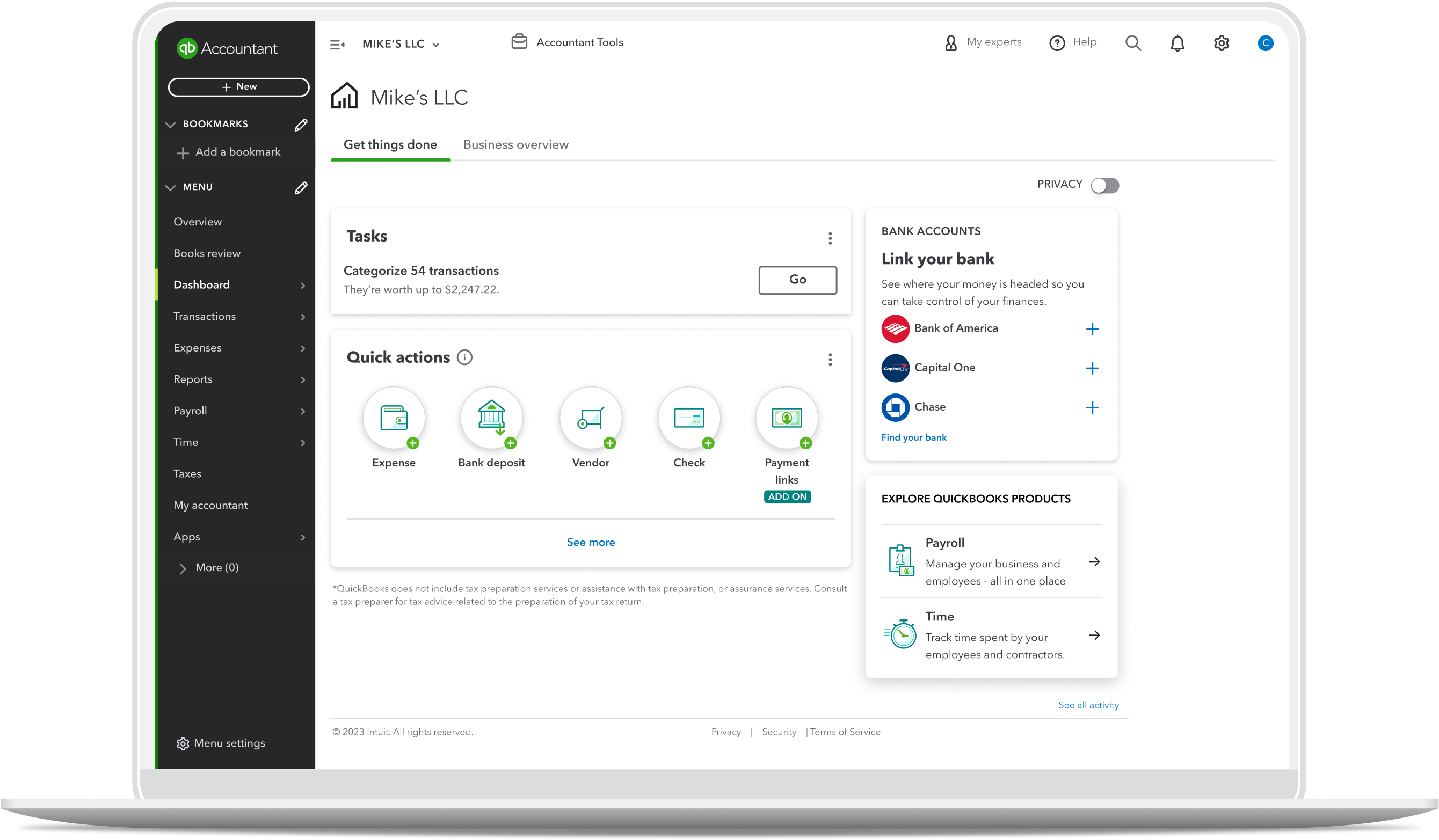

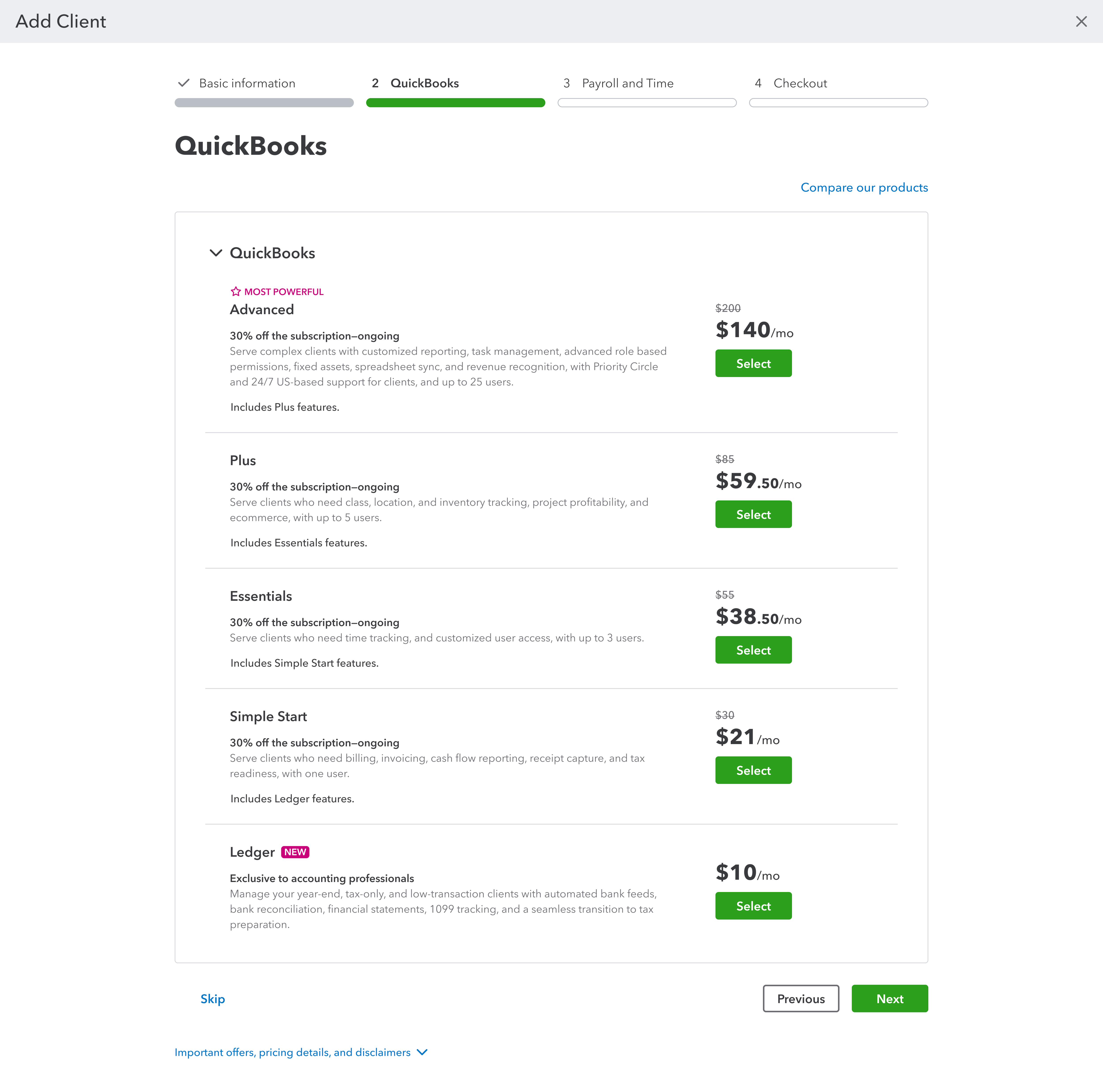

QuickBooks Ledger: A new, efficient solution for ledger clients

Add Client changes that right fit your client’s tech stack

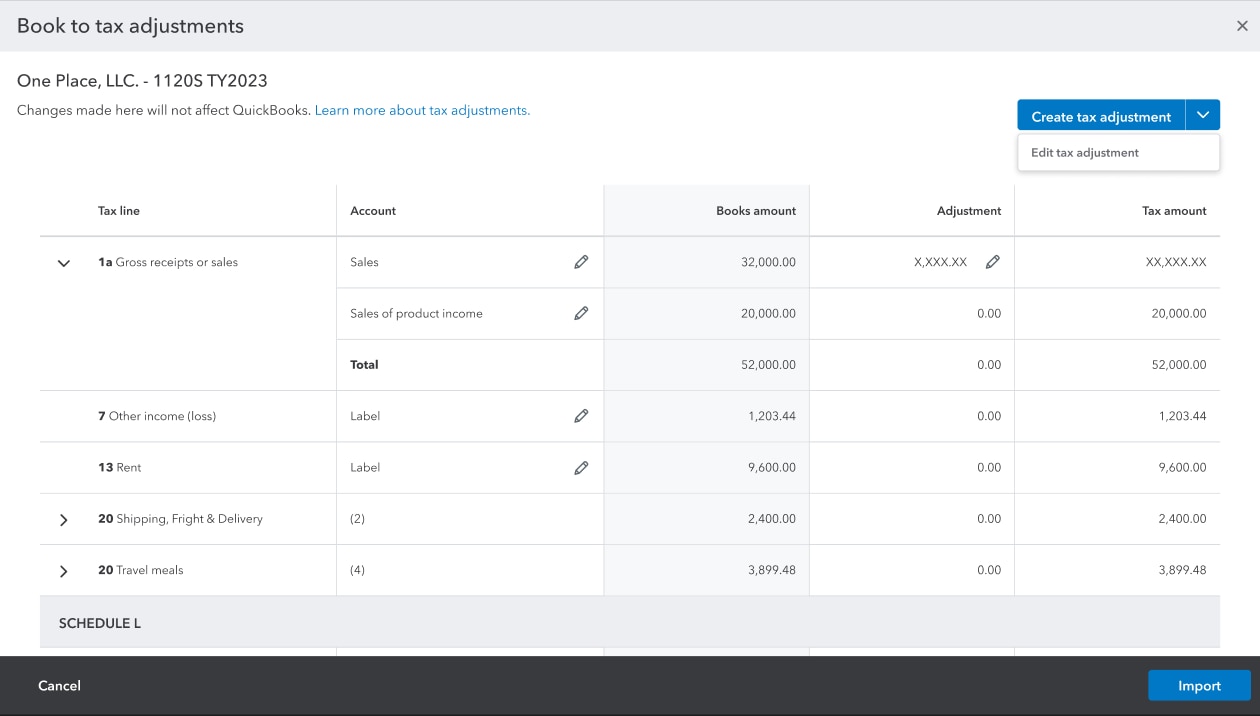

More flexibility in QuickBooks Online Accountant’s Prep for Taxes

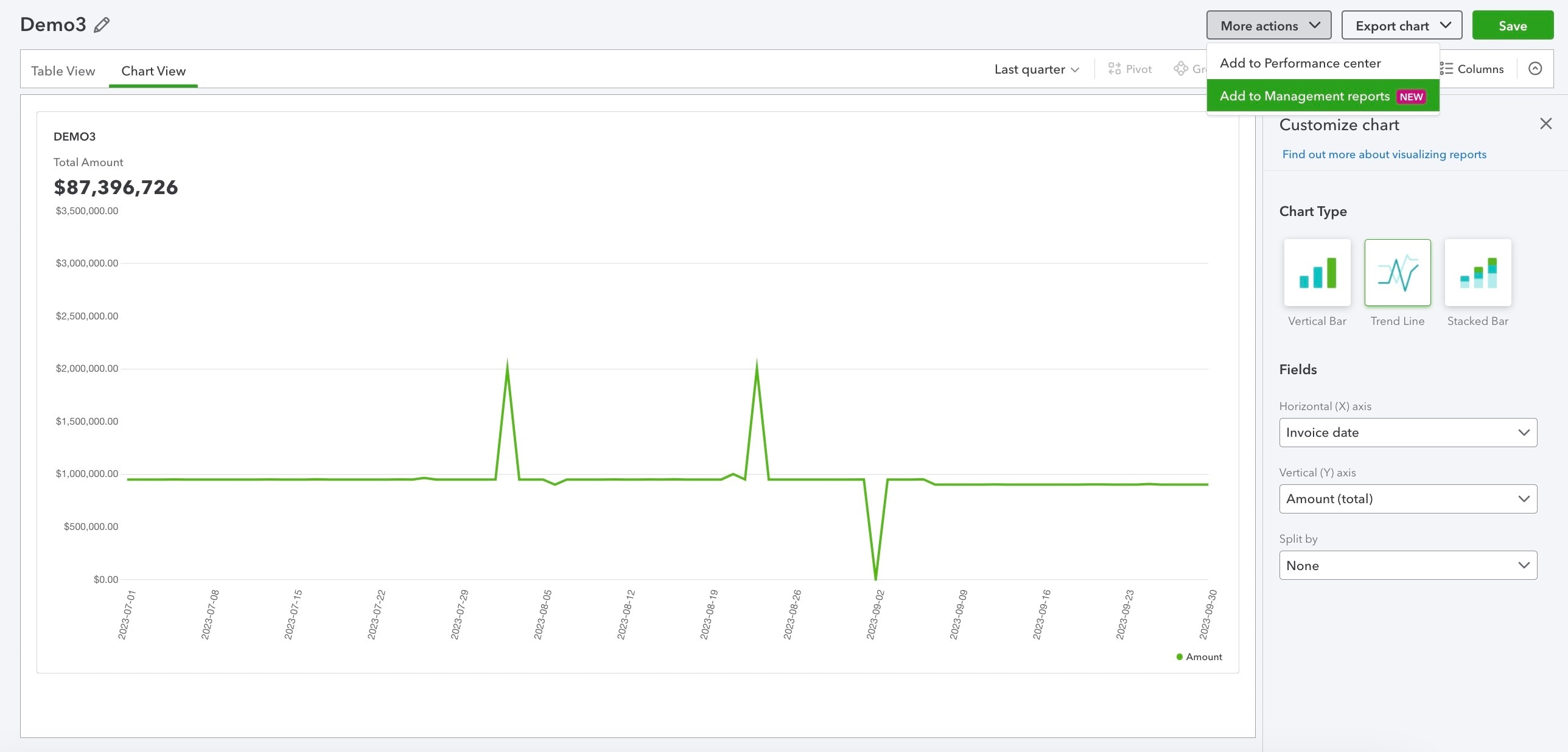

Add Custom report builder charts to client management reports in QuickBooks Online Advanced

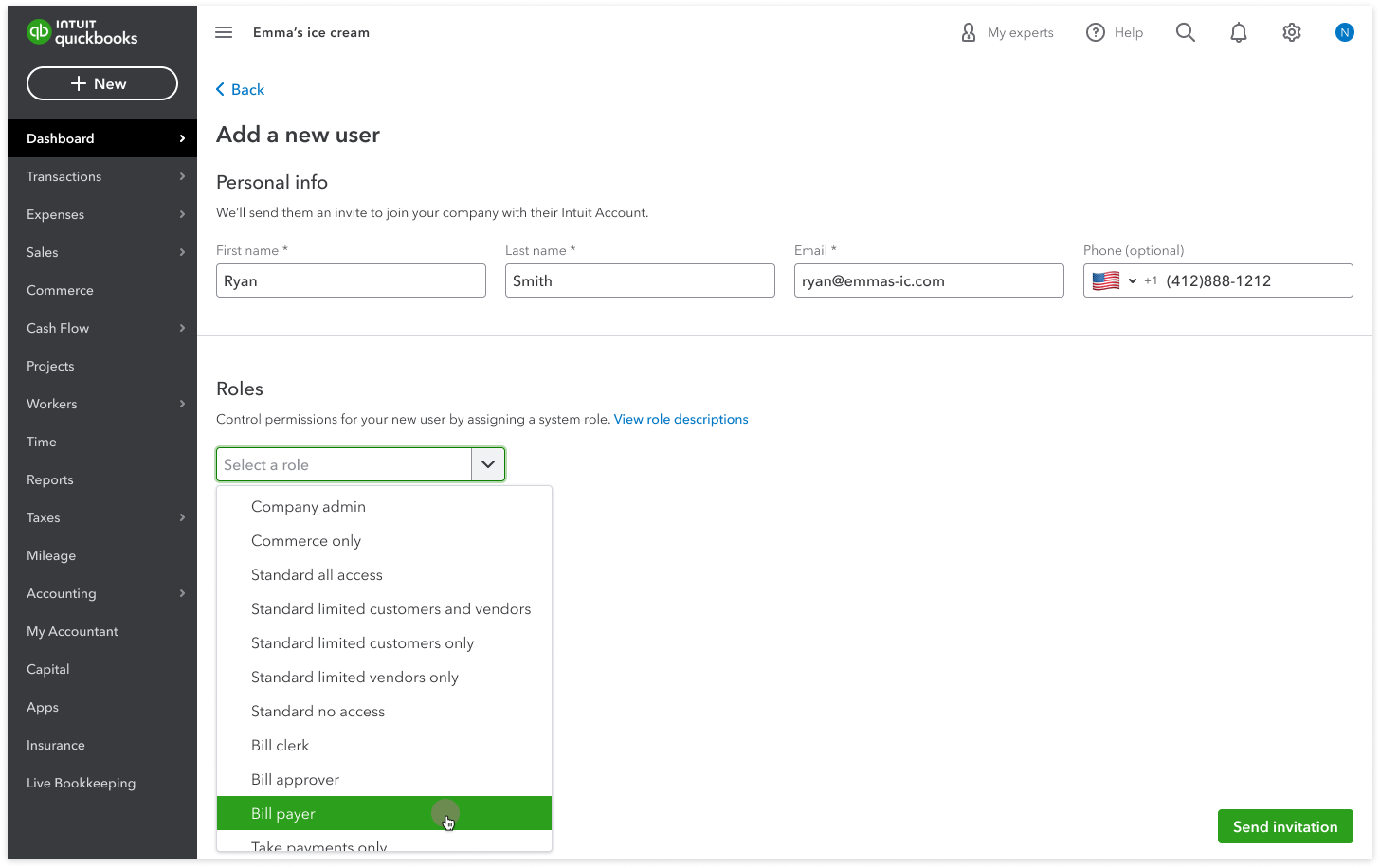

More control with additional custom roles in QuickBooks Online Advanced

Newly added training and certification exam in the ProAdvisor training portal