From cool weather to hot pumpkin-spiced lattes, there's a lot to enjoy in October. So settle in with a toasty mug and check out the new QuickBooks updates we've got for you this month.

In the Know Webinar: Register today for the next In The Know Webinar on Thursday, Oct. 19 at 11:00 AM PT, a monthly webinar for accountants to learn more about the latest and greatest product feature updates. This month, we’ll share our new Bill Pay product, as well as tips to start preparing for the upcoming tax season.

Share QuickBooks updates with your clients: Send them this link for QuickBooks innovations relevant to business owners and admins.

Your Feedback in Action: This is a regular series where we share relevant product improvements specifically driven by feedback from accountants. See the September edition for the latest updates.

What’s new in October

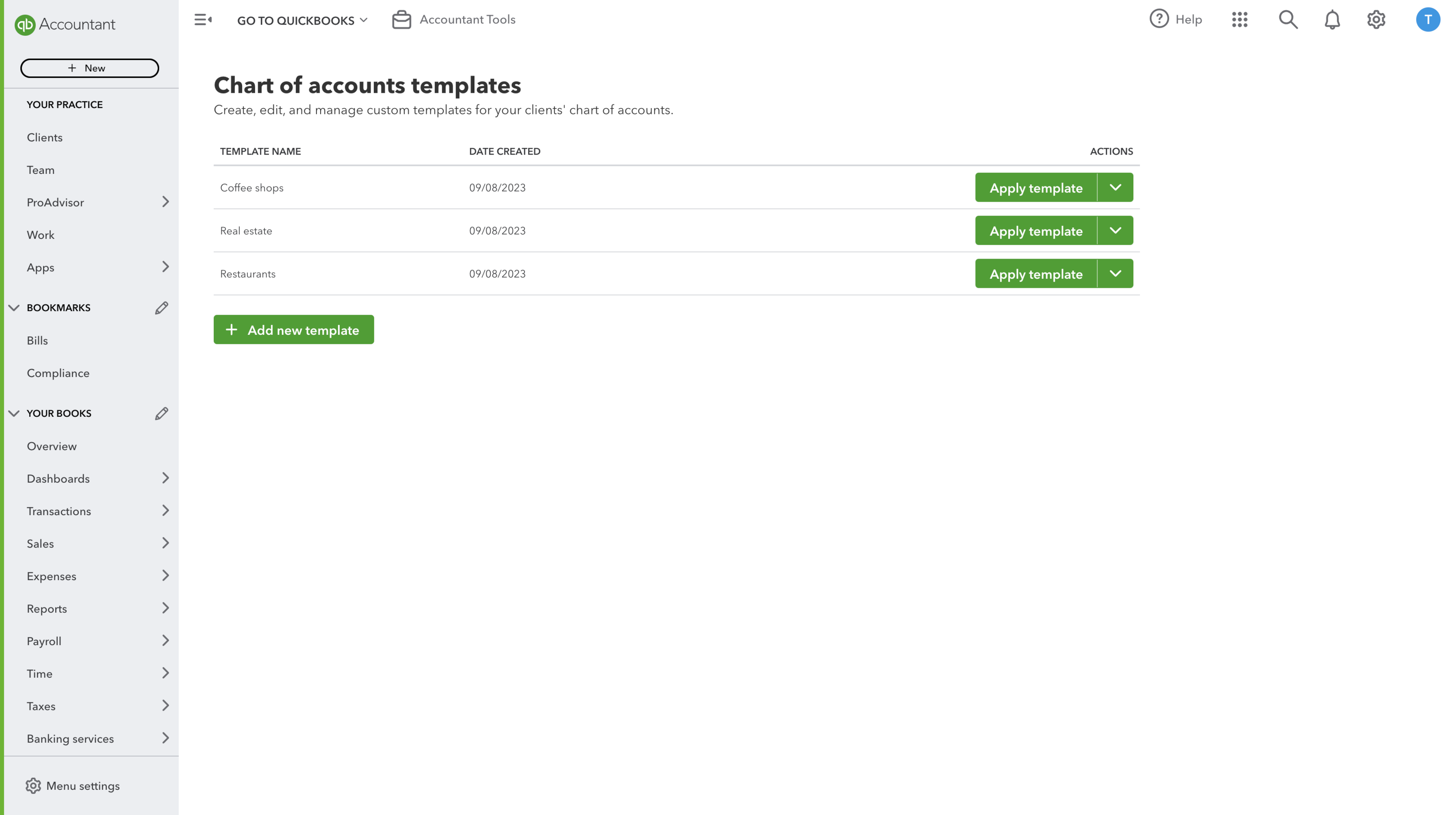

Chart of accounts templates

QuickBooks Desktop 2024 now available

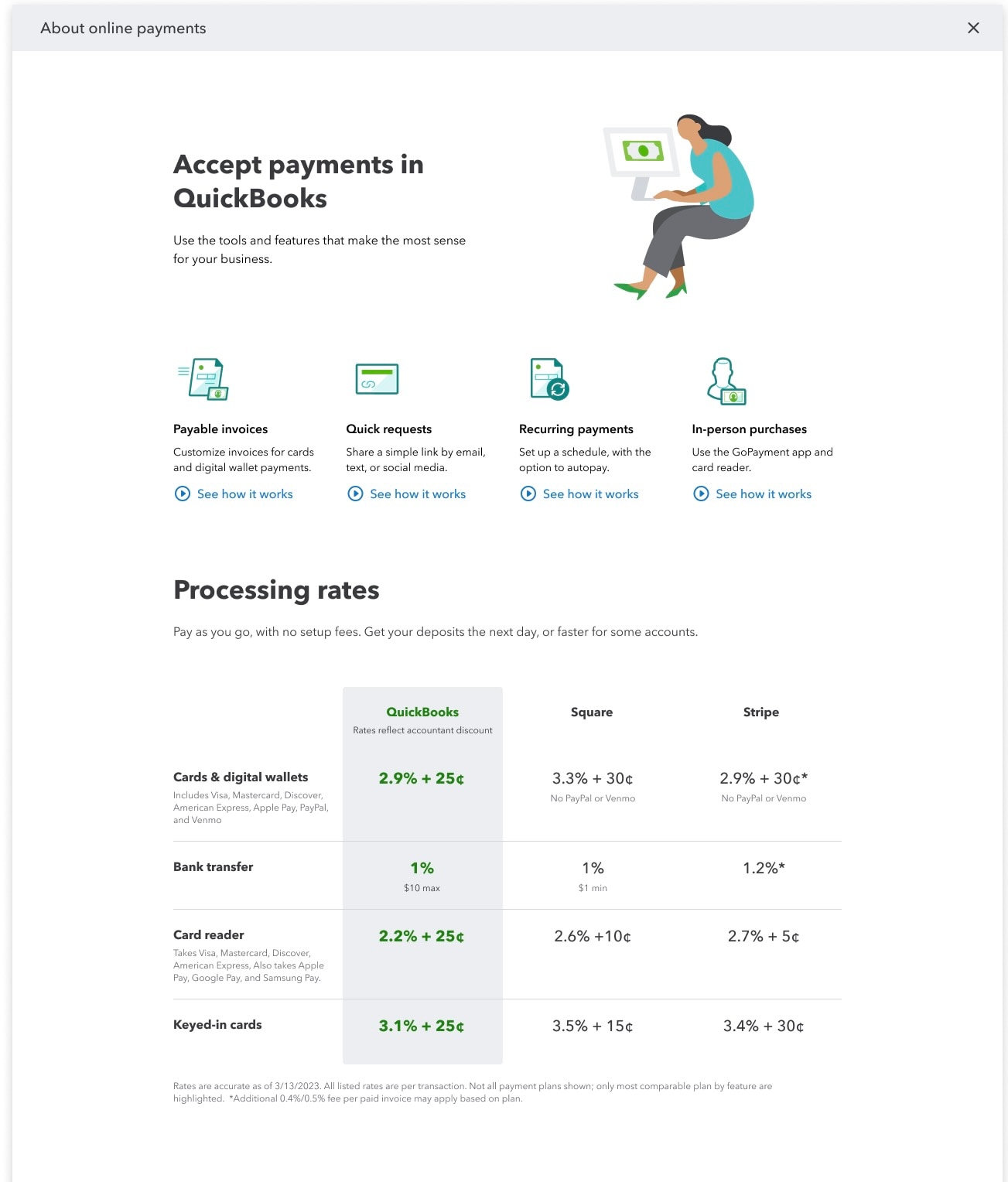

Payments information for clients includes discounted rates

QuickBooks Time PRO to be discontinued

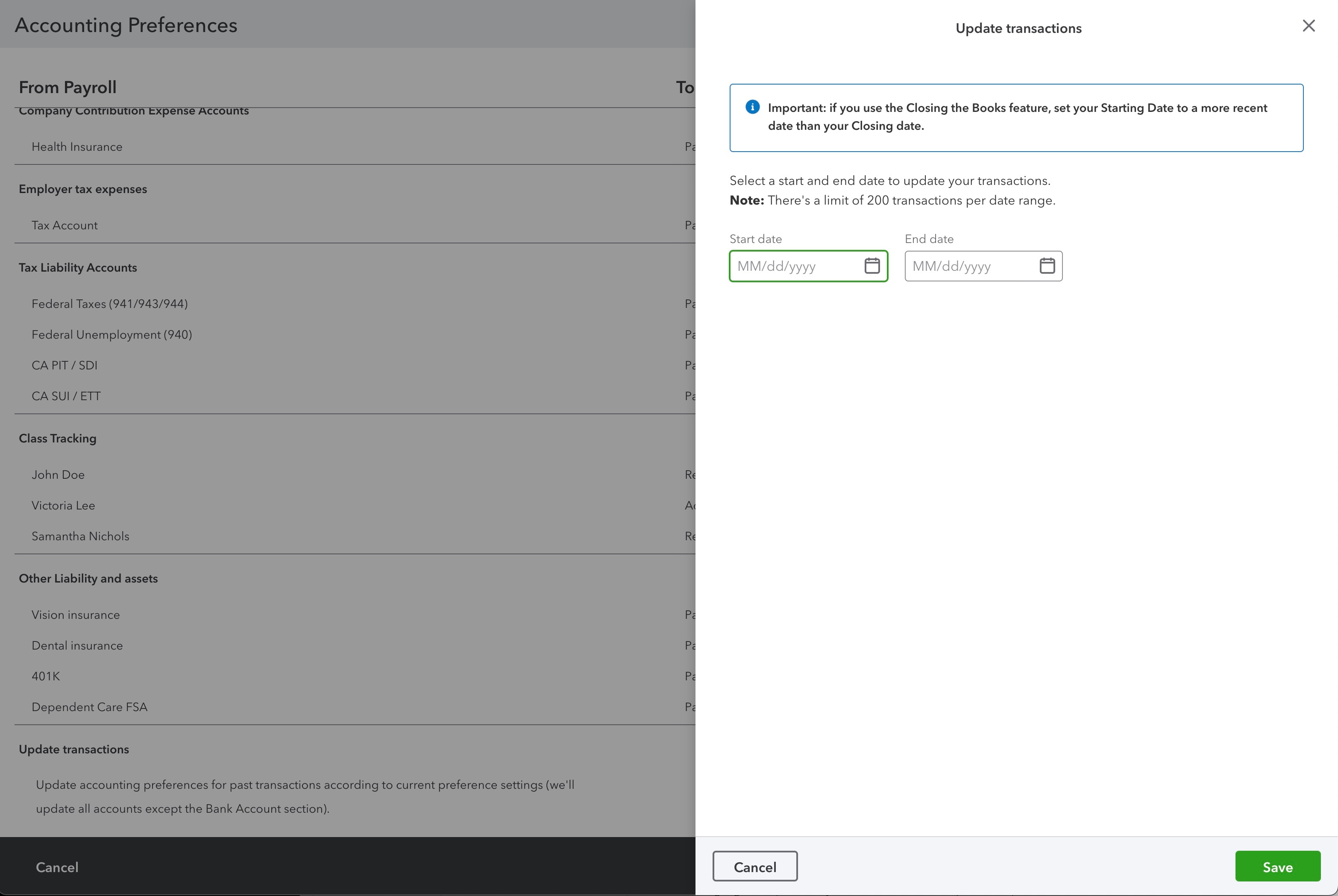

Updating existing transactions using exact time frames

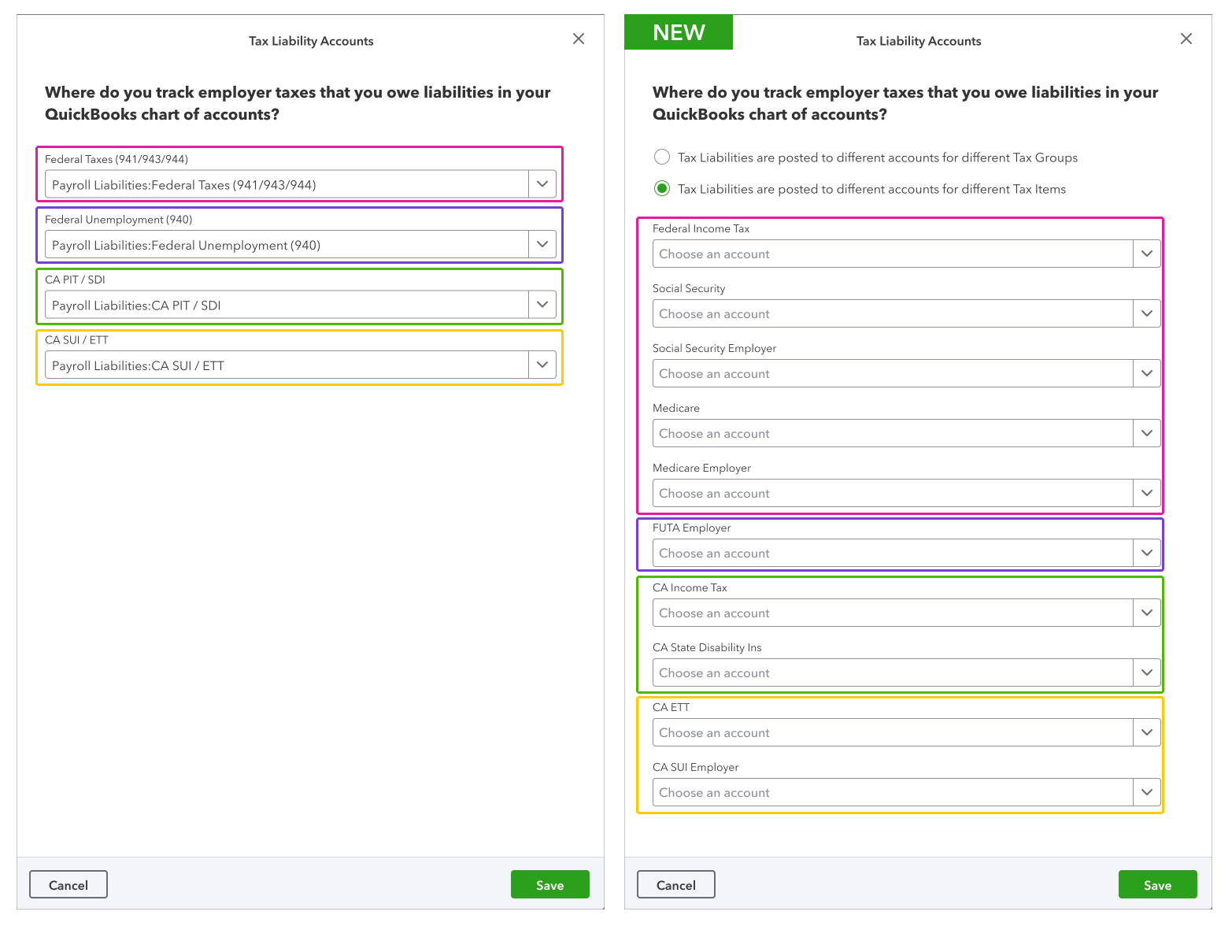

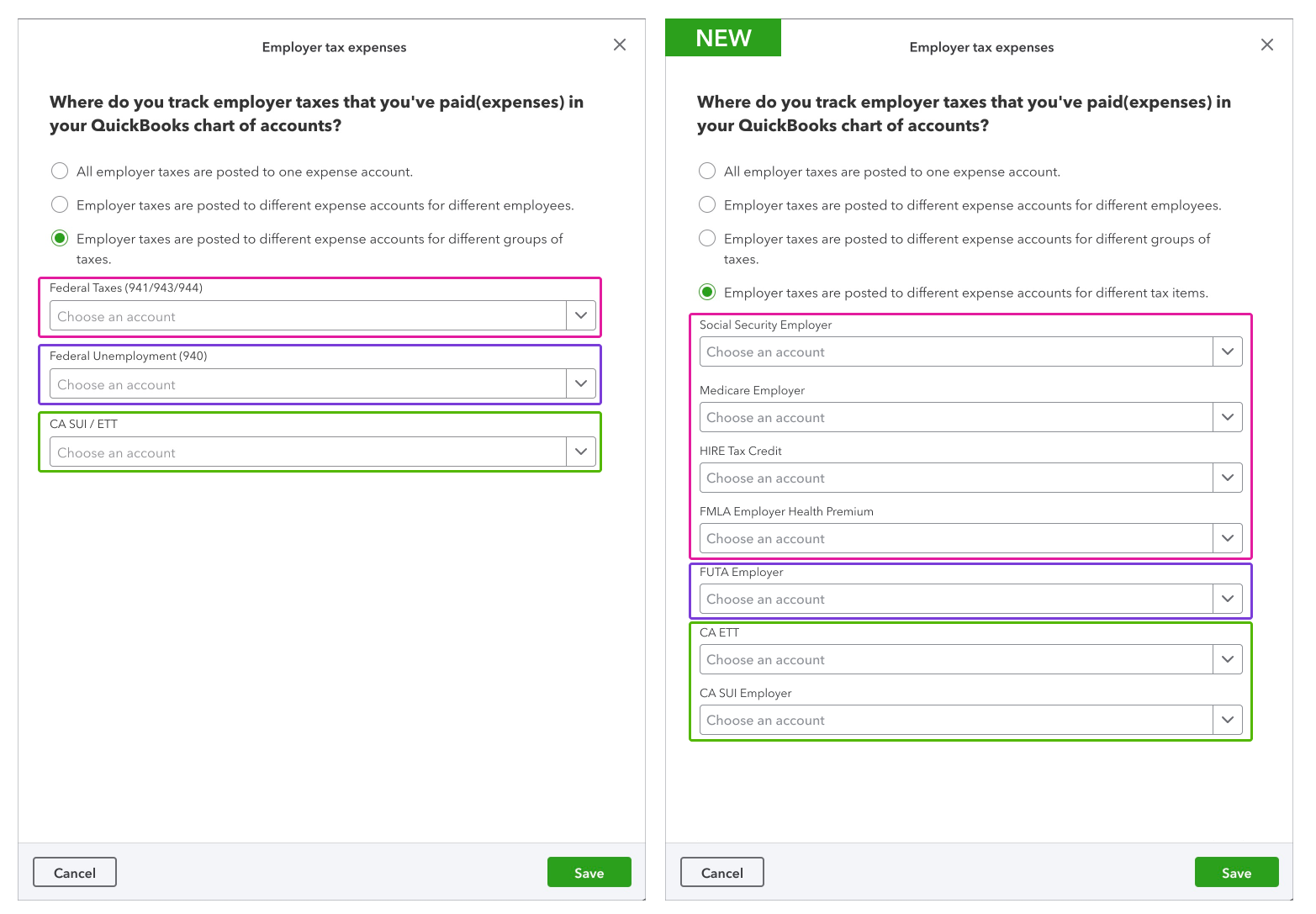

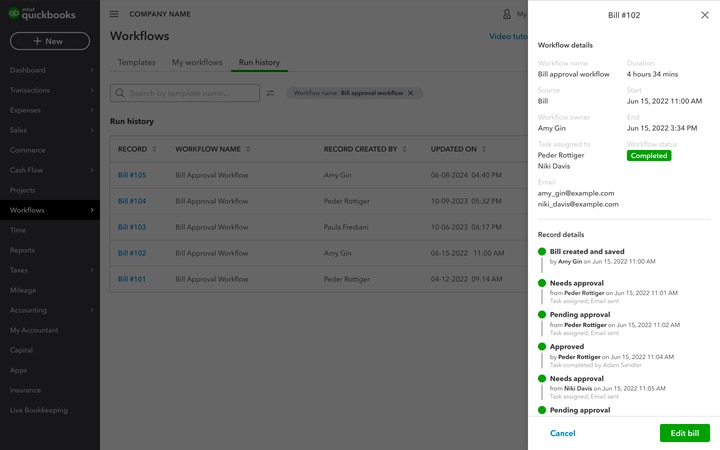

Increased flexibility when tax mapping

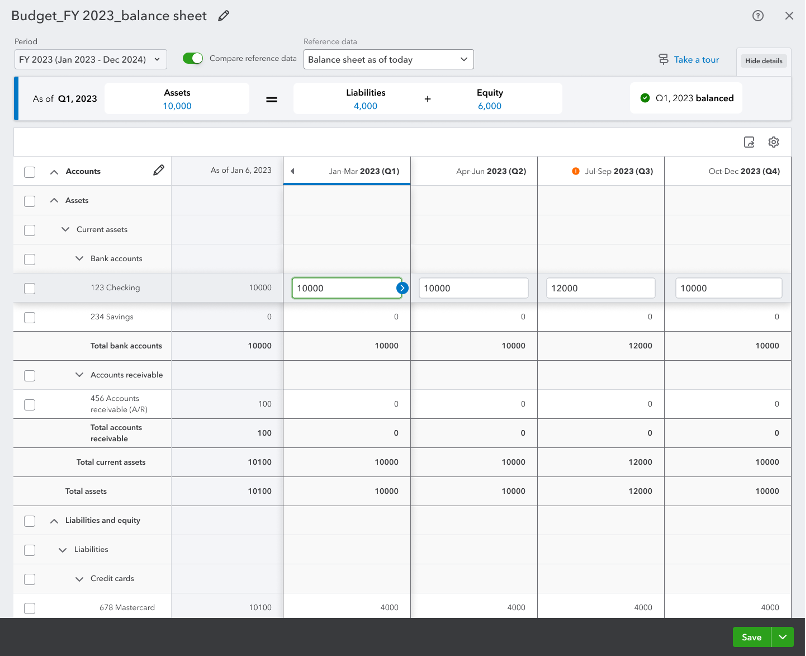

Balance sheet budgeting in QuickBooks Online Plus and Advanced

Tax readiness widget in QuickBooks Online Payroll

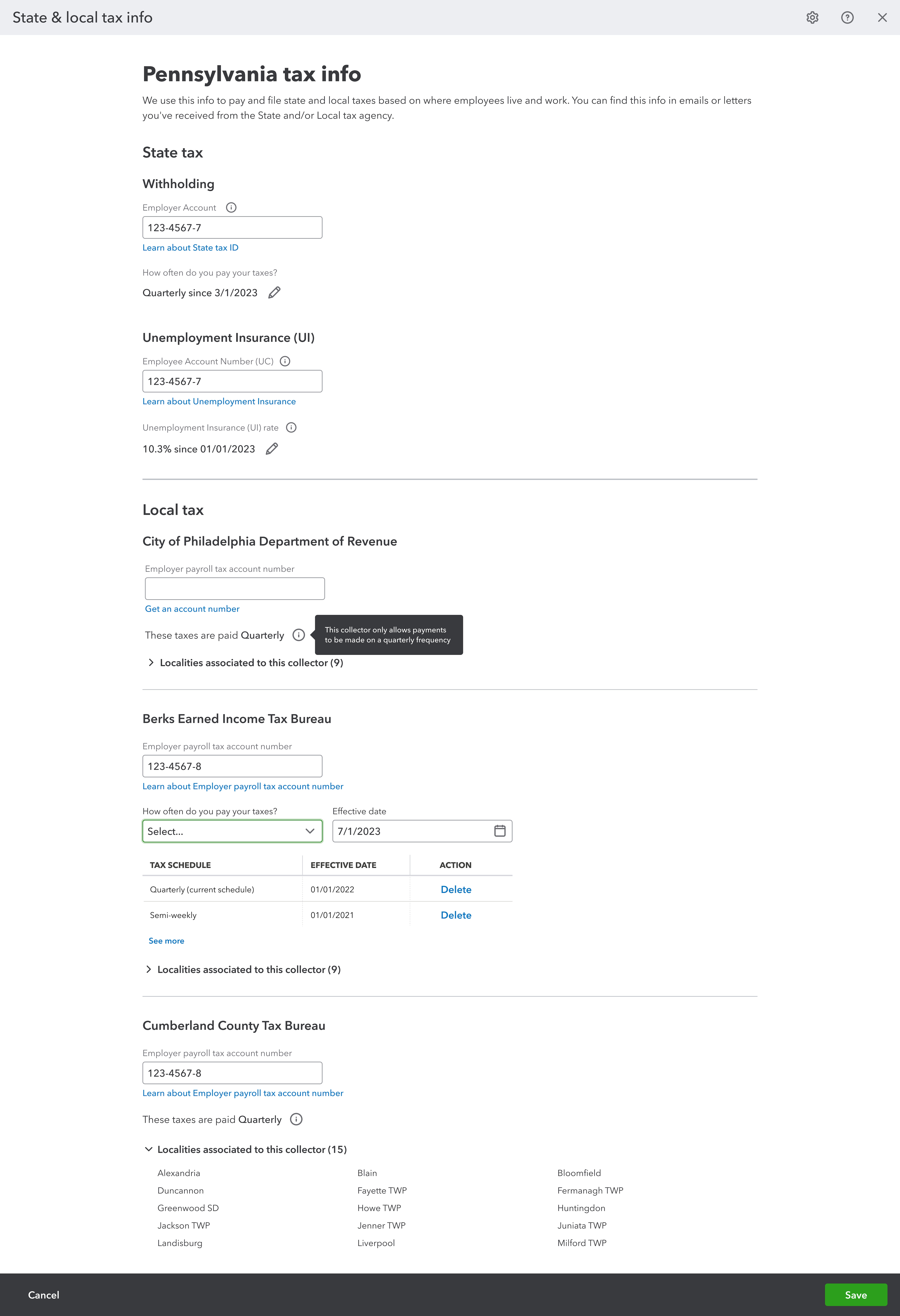

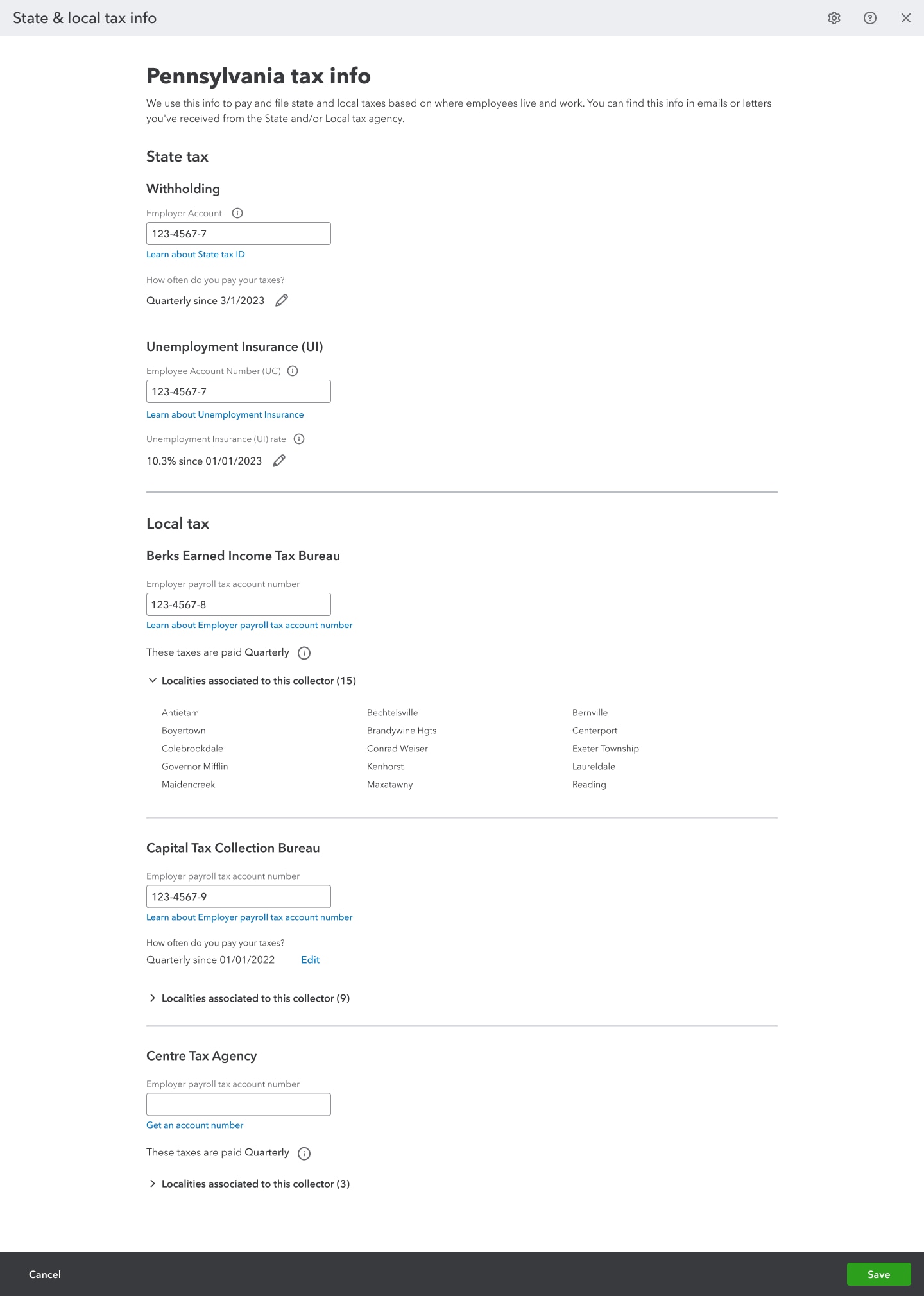

Automatic setting for local tax deposit frequency

Streamlining local tax collector information

Chase Bank requires bank account reconnection in QuickBooks