Detailed pricing for QuickBooks Online Payroll

Keep an eye out for discounts we may offer to help ease the transition for you and your clients. Once transitioned to ProAdvisor Preferred pricing, some customers will see increases, some will see decreases, and some won’t see significant changes.

Q: Will I be able to keep my tiered pricing?

No, we won’t offer tiered pricing based on the number of clients like there was in Intuit Online Payroll. The pricing for QuickBooks Online Payroll products will be based on the ProAdvisor Preferred Pricing program, with additional discounts as described above.

Q: What will my clients be told?

Firm-billed: We will not communicate with your firm-billed clients. We’ll leave that up to you. To help you with this, we’ve put together a guide on how to talk with your clients about the transition. See the guide

Client-billed: When you choose to transition, we’ll notify your client-billed clients with an email and messaging in their product that they are now eligible to transition as well. Once you’ve been invited to the voluntary transition period, you will be able to see a sample of the email in the product before we send it. If you have administrative permission for your client-billed clients, you can choose to transition their product for them by navigating to their company from the Client List, where you’ll see an option to transition.

Q: What about my firm’s payroll?

Along with your free QuickBooks Online Accountant subscription, you’ll also have QuickBooks Online Payroll Elite for free.* If you’re using Intuit Online Payroll for your firm’s payroll, we’ll transition you over to QuickBooks Online Payroll Elite. Learn more about Elite Payroll

Q: Are there any other tax implications/potential disruptions to my business/my client’s businesses?

Your firm’s payroll data, as well as your client’s payroll data – including W-2 filings, and Annual/Quarterly filings – will remain intact. When you transition, you are staying with Intuit, so there is no need to set up your tax filing again. In addition, your state tax setup will remain the same: you will not have to go back to each state and resubmit for the year.

Q: Will I still be able to prepare 1099s for my clients?

For your Intuit Online Payroll or Intuit Full Service Payroll clients, once they have transitioned to QuickBooks Online Payroll, you will be able to prepare and file 1099 forms directly from their QuickBooks Online Payroll account. The cost of these forms is already included in their Payroll subscription.

For any of your clients without a QuickBooks Online Payroll subscription, Intuit Online Payroll for 1099 is being replaced by QuickBooks Contractor Payments. For $15/mo (for up to 20 contractors), your clients can do unlimited next-day direct deposits, collect W9 and file unlimited 1099 for their contractors. The contractors will get a paper copy of the 1099 mailed to their address, and will be able to download their 1099 electronically. Learn more about QuickBooks Contractor Payments.

Q: Can I still export payroll data to QuickBooks Desktop?

Yes. Similarly to Intuit Online Payroll, you can export QuickBooks Online Payroll data into QuickBooks Desktop. See more info

Q: What is full-service payroll and do I have to use it?

Full service means we can take care of paying and filing taxes for you, and our agents are available to help if you need us to create a paycheck or make changes to your account. The full-service options are there if you choose to use them, but you can also turn them off if you prefer to be more hands on.

Q: Will I be able to add my Intuit payroll clients into my existing QuickBooks Online Accountant?

Once the transition is finished, we’ll provide instructions to log into QuickBooks Online Accountant. If you previously had a QuickBooks Online Accountant account, you’ll see two companies. Some Accountants may wish to keep their clients who were previously on Intuit Payroll separate from their other clients for ease of management. We are working toward a solution for those who would like to consolidate clients into a single account and will notify you when this is made available.

Q: What happens when I have Intuit payroll clients using QuickBooks Online?

When you transition your Intuit payroll clients to QuickBooks Online Payroll, they will transition to a standalone payroll product. The new stand-alone payroll account will be separate from their existing QuickBooks Online account. Customers wishing to import their payroll data to QuickBooks Online will still be able to do so, using the export function from QuickBooks Online Payroll to their QuickBooks Online account.

*We will be working on tools to combine separate accounts in coming months

Q: Can I merge a client’s new QuickBooks Online Payroll account with their existing QuickBooks Online account?

We don’t have this capability at this time. We are working to allow customers to combine their QuickBooks accounting and payroll products and will provide you with more information on that experience when this capability becomes available. Currently, your payroll client can continue to export into their QuickBooks Online account as they have done in Intuit Online Payroll or Intuit Full Service Payroll. Export into QuickBooks Online or Desktop from Core, Premium, or Elite Standalone Payroll

Q: I have QuickBooks Time clients also using Intuit Online Payroll or Intuit Full Service Payroll, what does this mean for me?

If your clients have QuickBooks Time, we’ll transition them to the QuickBooks Online Payroll product that aligns with their current QuickBooks Time level. For example, QuickBooks Time Premium users will transition to QuickBooks Online Payroll Premium, which includes the features of QuickBooks Time Premium.

Similarly, QuickBooks Time Elite users will transition to QuickBooks Online Payroll Elite, which includes the features of QuickBooks Time Elite.

Q: If I decide not to transition my clients to standalone QuickBooks Online Payroll, can I still access historical data (including payroll reports)?

If you cancel your service, we will provide historical access to your data for 7 years.

Q: How can I find out more about QuickBooks Online Payroll?

We have a variety of resources available, depending on your needs. You can also ask our Team by contacting support (either Intuit Online Payroll or Intuit Full Service Payroll support if you do not have a QuickBooks Online Accountant subscription, or contact ProAdvisor support if you have an existing QuickBooks Online Accountant subscription).

Q: What additional support will be available during this transition?

Once transitioned, you will have access to additional support from our ProAdvisor Team. They can make adjustments to prior payrolls, tax setup, or account settings.

Q: When a client has an existing QuickBooks Time subscription that is not linked to Intuit Online Payroll, will QuickBooks Time and QuickBooks Payroll Premium and/or Elite subscription automatically be bundled?

If your clients have QuickBooks Time, we’ll transition them to the QuickBooks Online Payroll product that aligns with their current QuickBooks Time level. For example, QuickBooks Time Premium users will transition to QuickBooks Online Payroll Premium, which includes the features of QuickBooks Time Premium. Once transitioned, your clients will be provided with a number in product that they need to call to finish connecting their existing QuickBooks Time account to their new Payroll product. During this call, billing for the existing QuickBooks Time account will be cancelled, since the cost is now included in Payroll.

Q: What options and control does the accountant or end user client have when migrating QuickBooks Time to the bundled QuickBooks Online Payroll Premium and/or Elite subscription?

Once transitioned, your clients will be provided with a number in product that they need to call to finish connecting their existing QuickBooks Time account to their new Payroll product. During this call, billing for the existing QuickBooks Time account will be cancelled, since the cost is now included in Payroll.

Q: When migrating an IOP client to QuickBooks Online Payroll subscriptions, what are the steps?

See How will the transition work? above.

Q: What other advice do you have for accountants and end user clients during the sunset migration of Intuit Online Payroll?

The process of transitioning is designed to be seamless, and your data stays where it is. That means you can pick up running payroll right after your transition is complete, if needed. Our advice for firms is to familiarize any staff who will be managing client accounts with QuickBooks before the transition occurs. There are many companies who offer QuickBooks tutorials online, but we also recommend exploring the QuickBooks ProAdvisor certified training, which will allow you to quickly get up to speed on the features and benefits of QuickBooks Payroll.

Important disclaimers

* Free QuickBooks Online Payroll Elite subscription available to accounting firms that manage a client’s QuickBooks Online Payroll subscription. Ongoing offer valid while an accountant has an existing and active QuickBooks Online Accountant account.

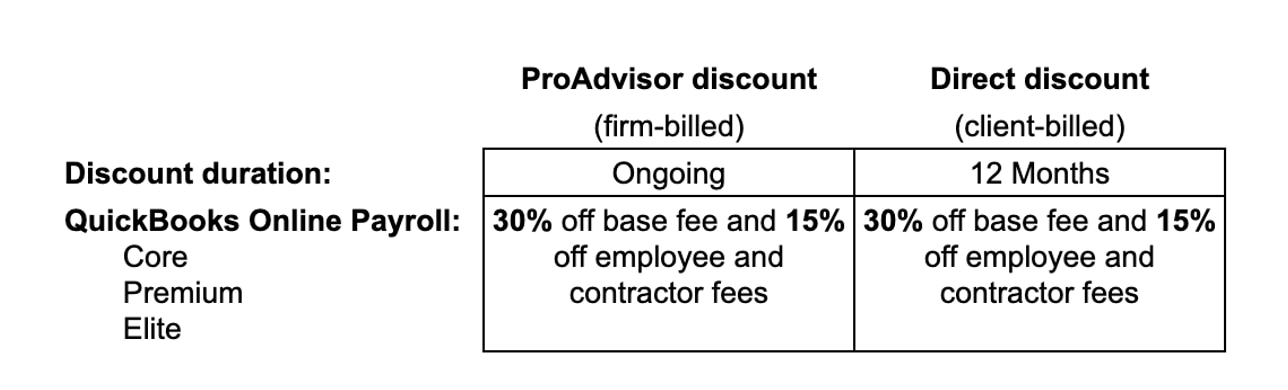

* ProAdvisor Preferred Pricing. Offer available to accounting firms who register or have registered for QuickBooks Online Accountant (“QBOA”) and use the ProAdvisor Discount option (“QBOA Customer”) for QuickBooks Online Payroll (“QBOP”) subscription fees. The ProAdvisor Discount means that the QBOA user agrees to pay for the client subscription fees (“ProAdvisor Discount”). Discount and list price subject to change at any time at Intuit’s sole discretion. All prices are quoted without sales tax. If you add or remove services, your service fees will be adjusted accordingly. All QuickBooks subscriptions must be entered through ProAdvisor Discount. The discount is valid only for the named individual or company that registered for QuickBooks subscription and cannot be transferred to another client, individual, or company. Cannot be combined with any other Intuit offer. Offer valid for a limited time only, only in the U.S., and is non-transferable. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

* Direct discount pricing. Offer available to accounting firms who register or have registered for QuickBooks Online Accountant (“QBOA”) and use the Client Discount option for the QuickBooks Online Payroll (“QBOP”) subscription fees (“QBOA Customers”). The Client Discount invoicing option means that the client is billed for the QuickBooks subscription fees directly (“Client Discount”). The Client Discount will apply for the first 12 months of the service for their client starting from the date of enrollment, followed by the then-current fee for the service. Discount and list price subject to change at any time at Intuit’s sole discretion. All prices are quoted without sales tax. If you add or remove services, your service fees will be adjusted accordingly. The discount is valid only for the named individual or company that registered for QuickBooks subscription and cannot be transferred to another client, individual, or company. Cannot be combined with any other Intuit offer. Offer valid in the US only and is non-transferable. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

** Features

Automated tax payments and filings: Automated tax payments and filing available for state and federal taxes. Enrollment in e-services is required for tax payments and filings only. Automated tax payments and filings for local taxes available in QuickBooks Online Payroll Premium and Elite only.

Auto Payroll: Available if setup for the company is complete. At least one employee has completed setup and has consistent payroll that qualifies for automation (i.e. salaried or hourly with default). Company must complete bank verification if Employee has direct deposit as the payment method, and the first payroll must run successfully. The account must not have a hold.

Next-day direct deposit: Payroll processed before 5 PM PT the day before shall arrive the next business day (excluding weekends and holidays). Requires setup of direct deposit and bank verification. May be subject to eligibility criteria. Deposit delays may occur because of third party delays, risk reviews, or issues beyond Intuit’s control. Available for contractors and employees. Additional fees may apply to direct deposit for contractors.

Health benefits: Health insurance benefits are provided by Intuit Insurance Services Inc., a licensed insurance broker, through a partnership with Allstate Health Solutions. Requires acceptance of Allstate's Terms of Use and Privacy Policy. Intuit Insurance Services is owned and operated by Intuit Inc. and is paid a percentage fee of insurance policy premiums by Allstate Health Solutions in connection with the services described on this page.

Same-day direct deposit: Available to QuickBooks Online Payroll Premium and Elite users only. Payroll processed before 7 AM PT shall arrive the same business day (excluding weekends and holidays). Requires setup of direct deposit and bank verification. May be subject to eligibility criteria. Deposit delays may vary because of third party delays, risk reviews, or issues beyond Intuit’s control. Available only for employees, not available for contractors.

QuickBooks Time: Time tracking included in the QuickBooks Online Payroll Premium and Elite subscription services. Features vary. The QuickBooks Time mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Expert setup review: Available upon request for QuickBooks Online Payroll Premium and Elite.

HR services: HR support is provided by experts at Mineral, Inc. Requires acceptance of Mineral’s Privacy Policy and Terms of Service. HR support center is available only to QuickBooks Online Premium and Elite subscriptions. HR advisor support is only available in QuickBooks Online Payroll Elite. HR support is not available to accountants who are calling on behalf of their clients.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.