As we look back on 2023, we’re happy to have shared it with all of the accounting and bookkeeping professionals in the QuickBooks community. Thank you for the insightful feedback that led to all of this year’s updates.

Share QuickBooks updates with your associates and clients: Send them this link for QuickBooks innovations relevant to business owners and admins.

Your Feedback in Action

This is a regular series where we share relevant product improvements specifically driven by feedback from accountants. See the summary article for the latest updates.

What’s new in December

Top QuickBooks Online product innovations of 2023

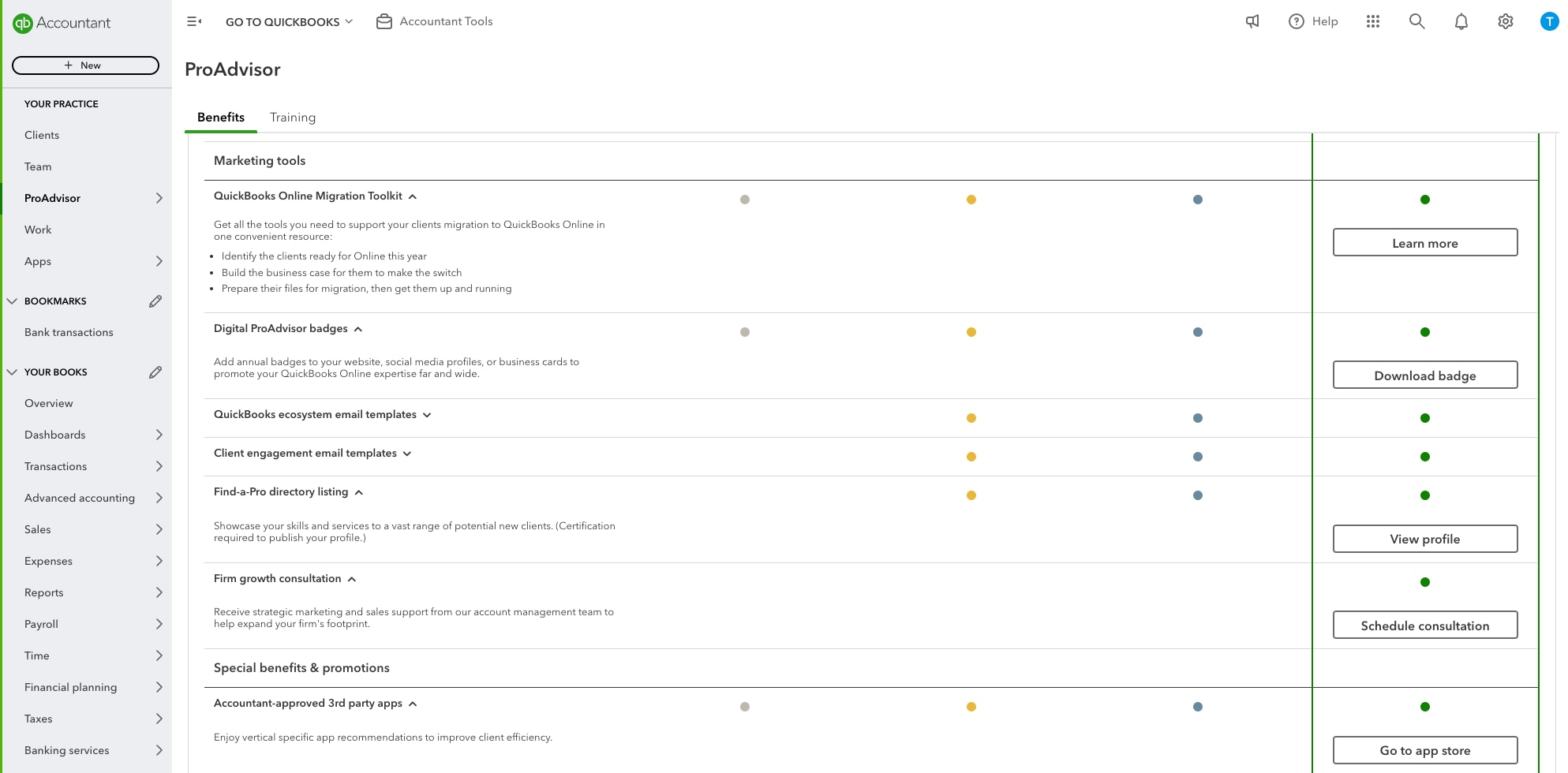

The reimagined ProAdvisor Program

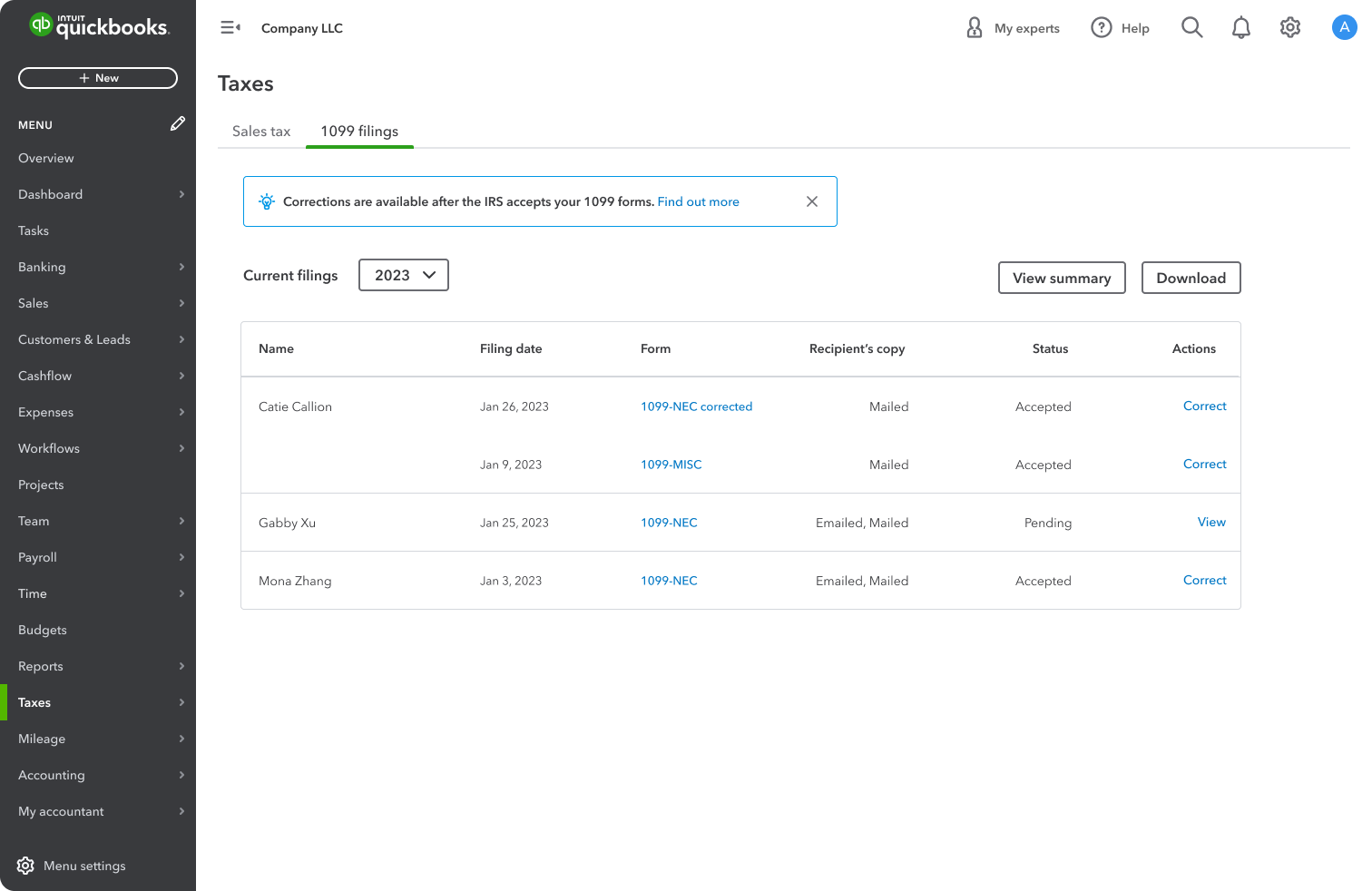

An easier, smarter 1099 experience

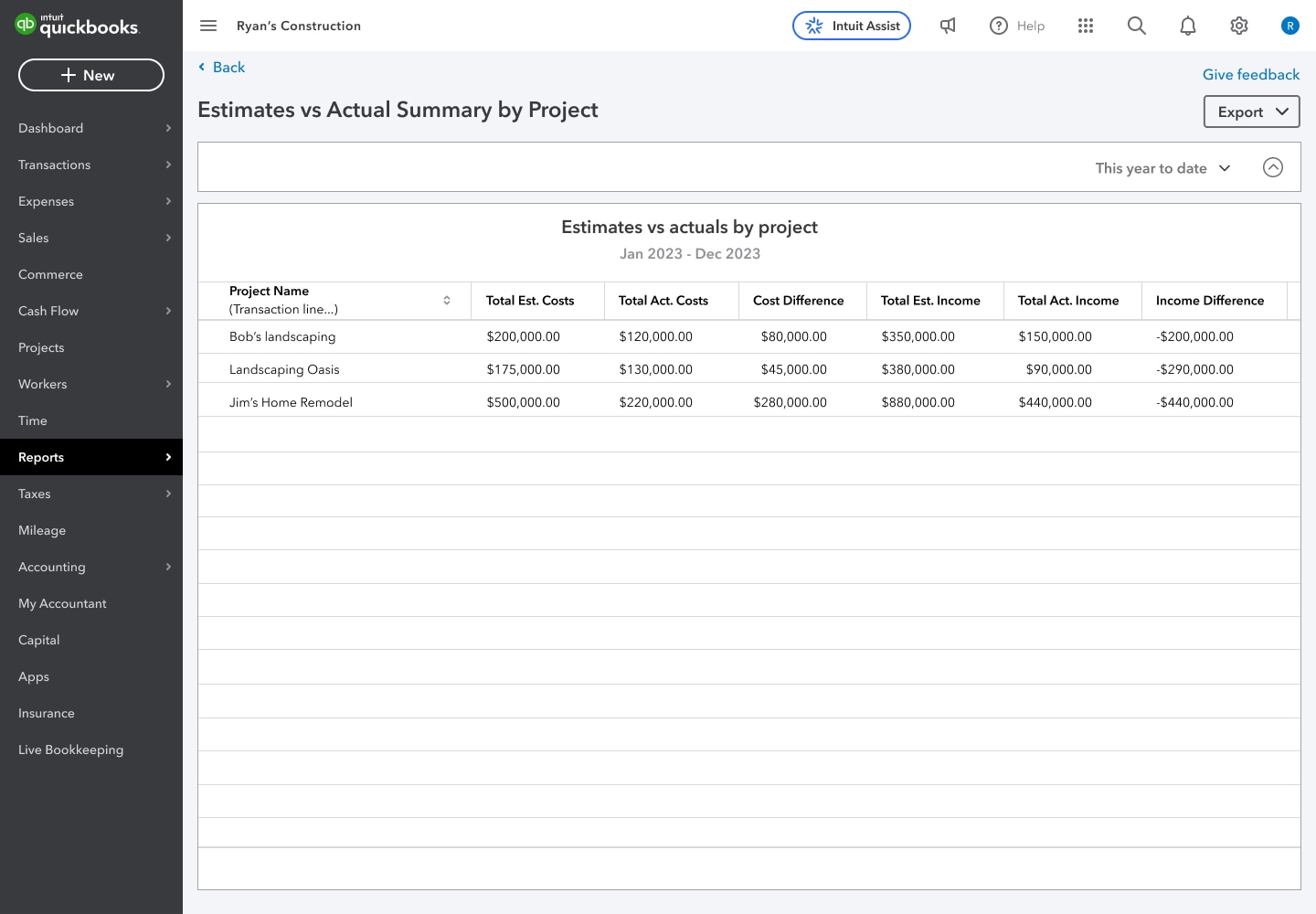

New project-based reports provide more insights to clients

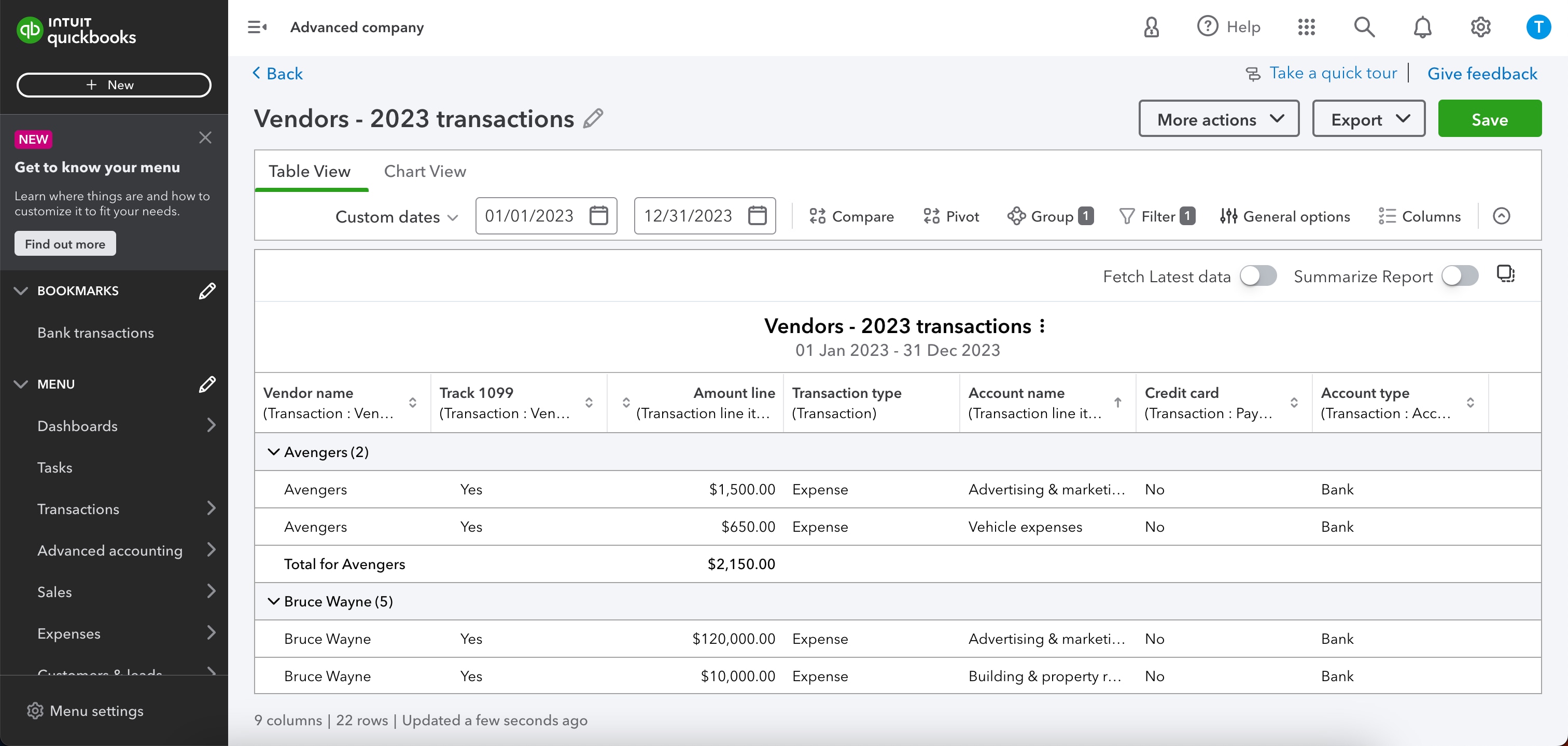

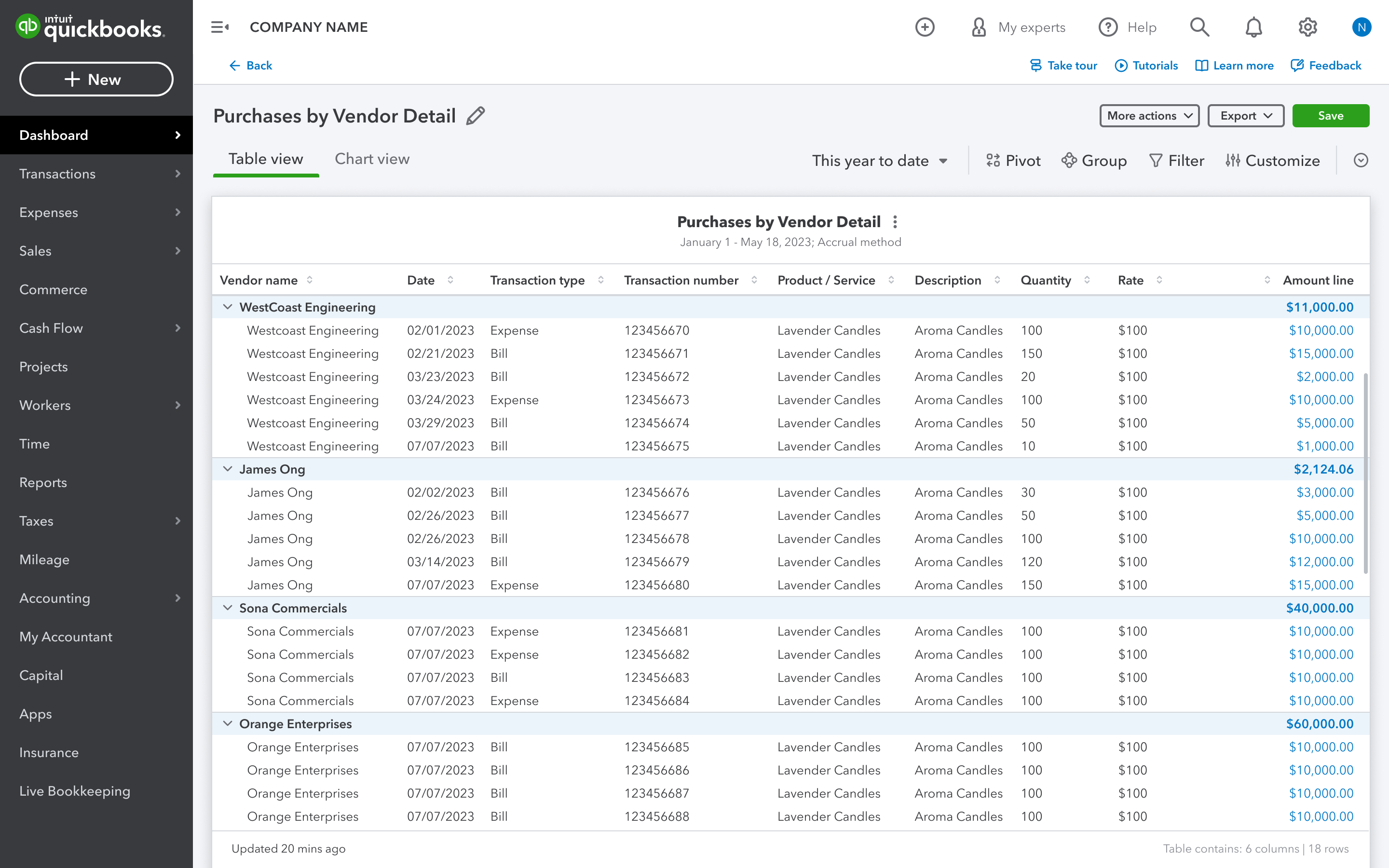

A simplified and more flexible view of expense reports

Import subdivided budgets in QuickBooks Online Plus and Advanced

Faster ACH payments and optional next-day delivery for QuickBooks Bill Pay

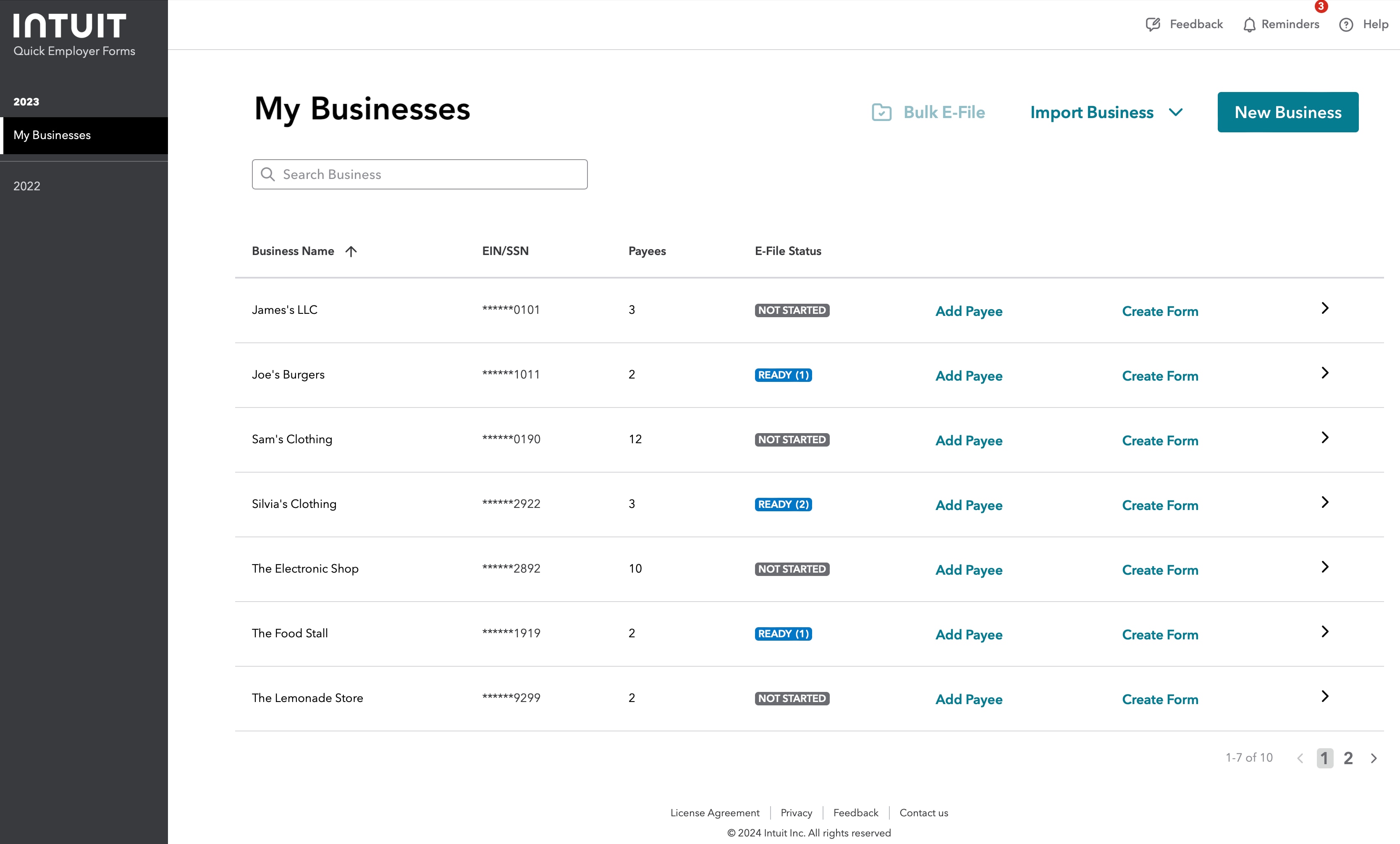

Create and e-file unlimited W-2s and 1099s quickly with Quick Employer Forms Accountant

Coming soon: Expert support for claiming tax credits