Although our goal is to honor accounting professionals year-round, May 19 just happens to be Accounting Career Day and National Accounting Day. Thank you for working tirelessly to help business owners achieve their financial goals. #PartnersInProsperity

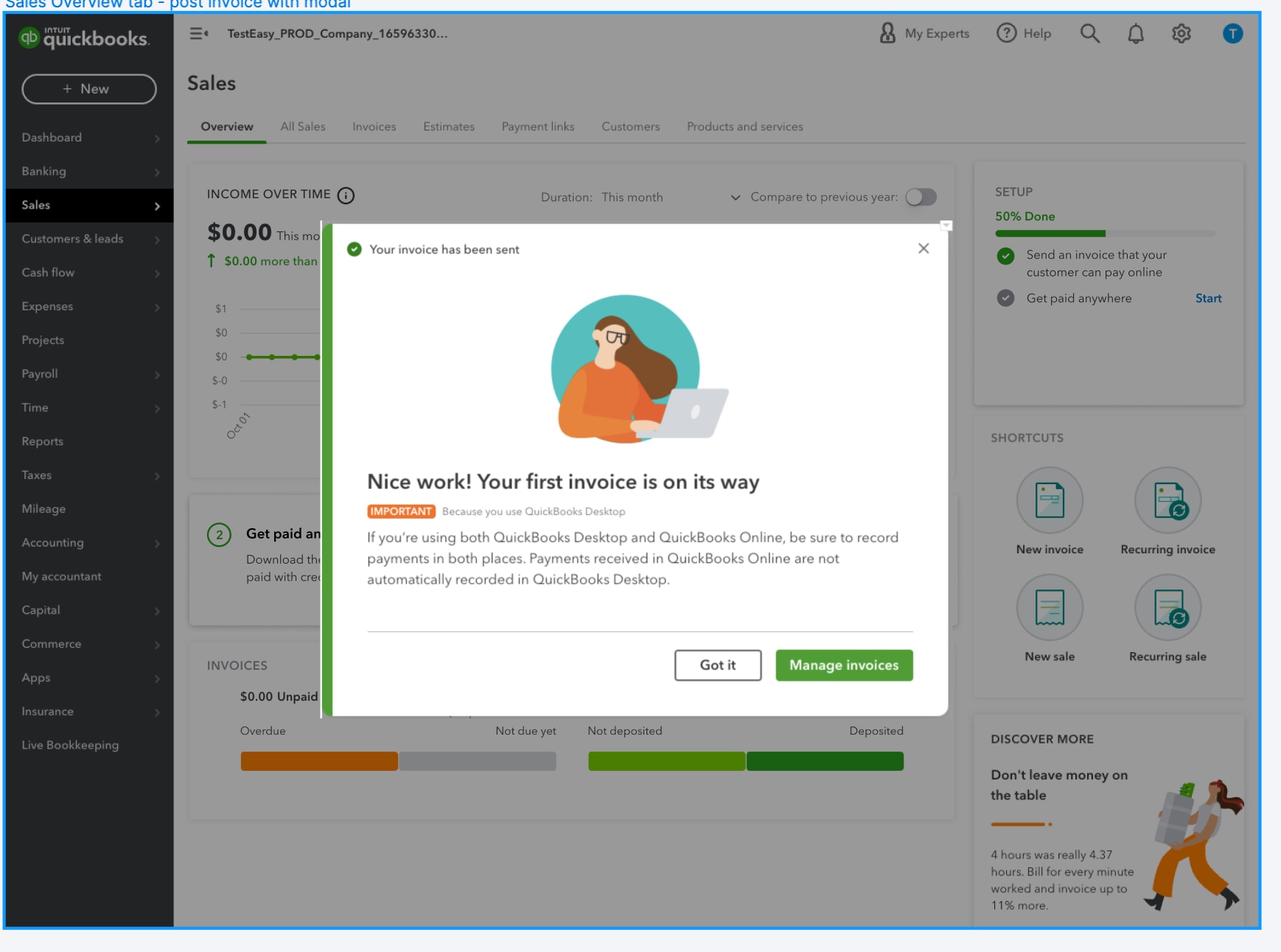

Share QuickBooks updates with your clients—Send them this link for QuickBooks innovations relevant to business owners and admins.

In the Know Webinar

Register today for the next In The Know Webinar on Thursday, May 25 at 11:00 AM PT, a monthly webinar for accountants to learn more about the latest and greatest product feature updates. This month, join us to learn about the QuickBooks Online Desktop app, and stay current with all the recently added ProAdvisor training. Reserve your spot

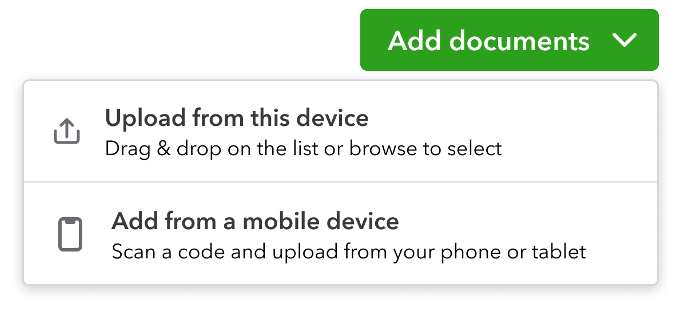

Your Feedback in Action

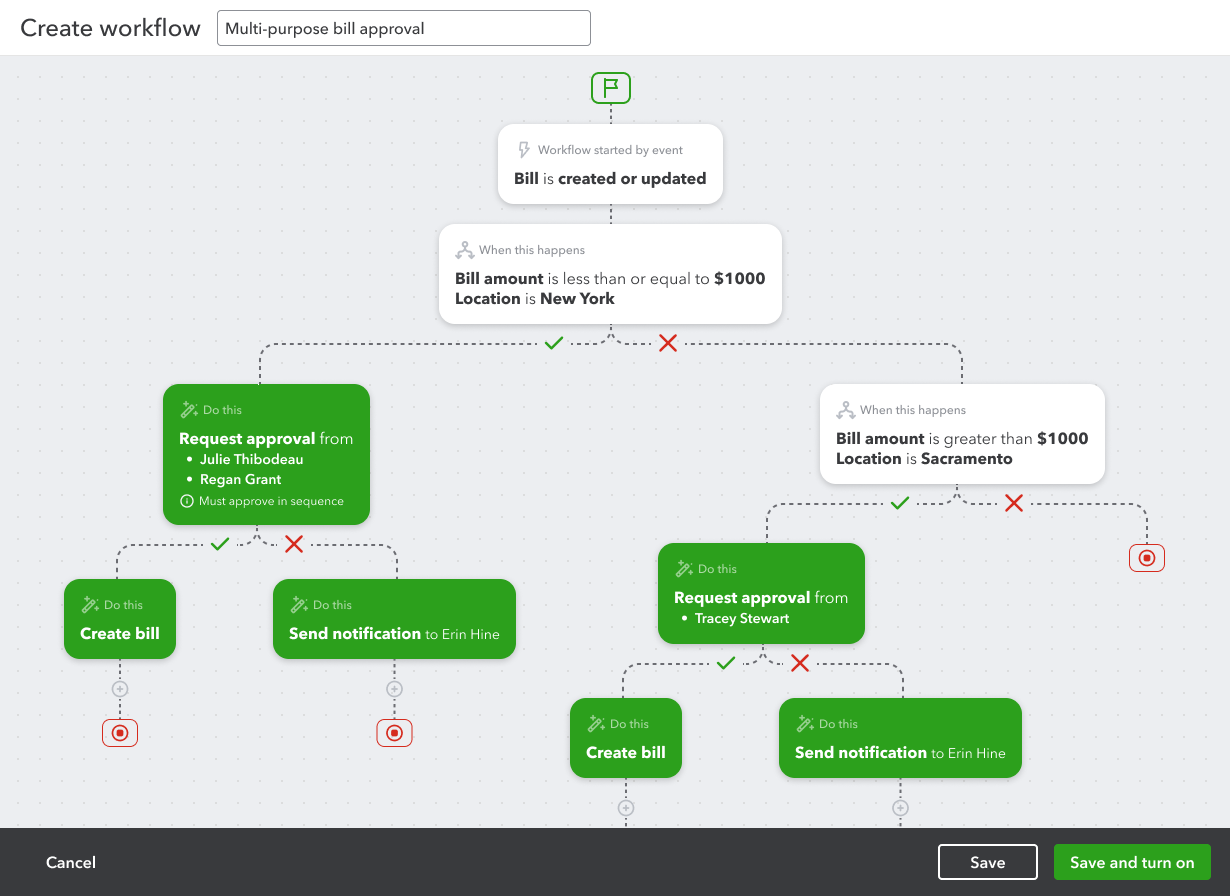

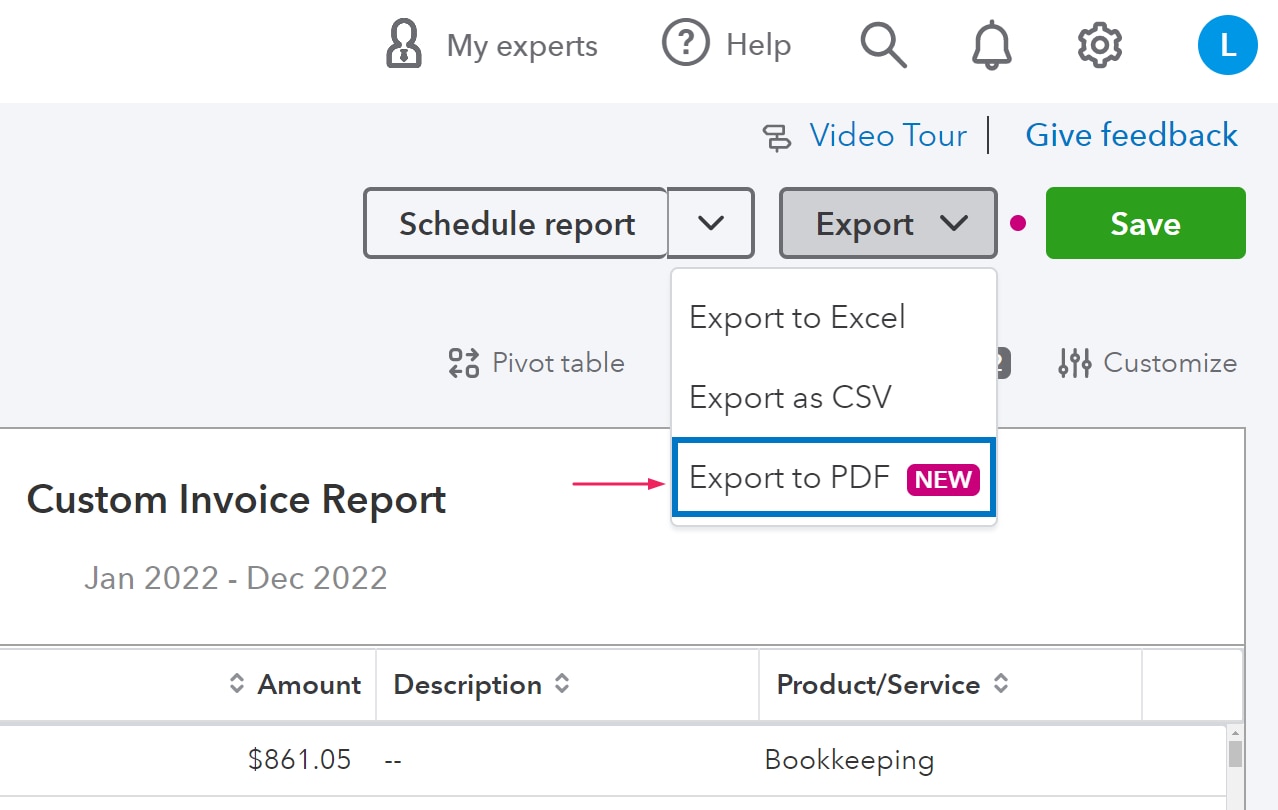

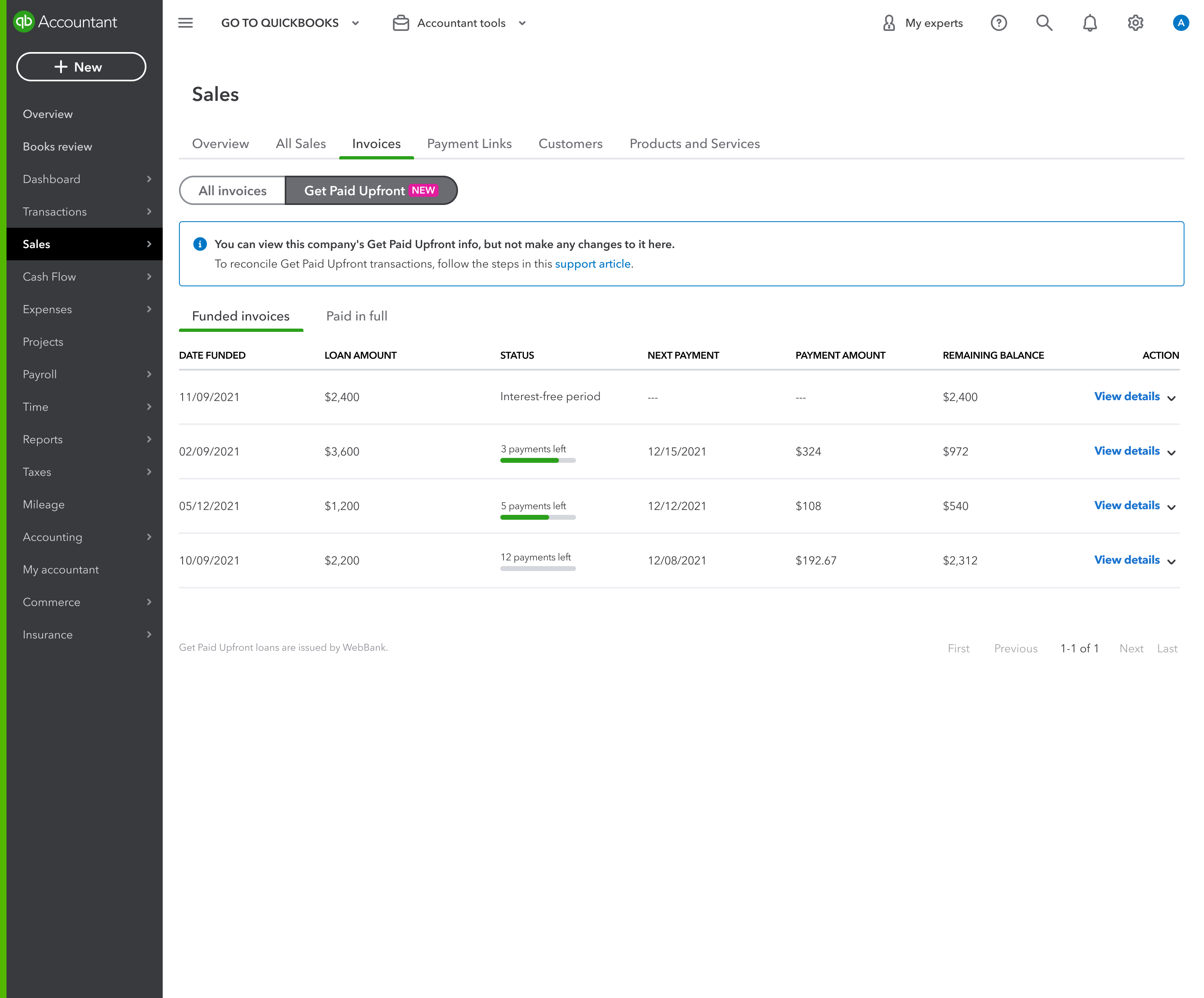

A series of quick reads where we share product improvements specifically driven by feedback from the accountant community. Check out the May edition to see the most recent updates.