An email was sent to QuickBooks accounting professionals on Nov. 1, 2023, announcing upcoming pricing changes coming to QuickBooks Desktop Payroll and Payments that will impact some of your clients starting in December 2023.

QuickBooks Desktop Payroll

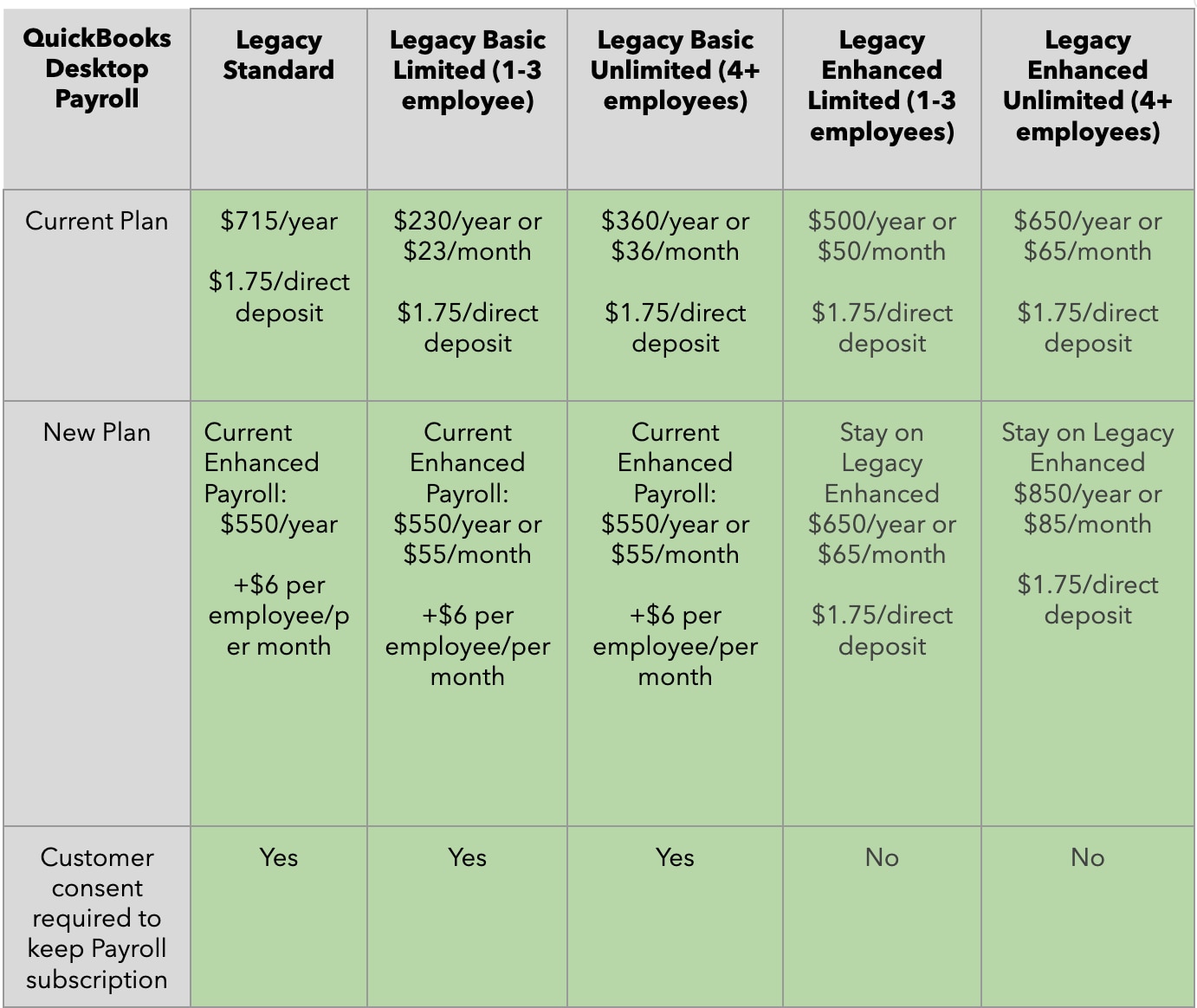

Starting Dec. 1, 2023, we are ending support for legacy Standard Payroll and legacy Basic Payroll. Clients on these plans will be rolled into the “current” Enhanced Payroll with additional functionality to e-file and e-pay federal and state payroll taxes. These changes will take effect on your client's subscription renewal date.

Clients impacted by this change will be notified of this update in product and via email to provide consent in the Customer Account Management Portal (CAMPS). If we do not receive clients’ consent prior to their subscription renewal date, their payroll service will be terminated and they will need to contact Intuit to subscribe to a new payroll and link their prior Payroll history. See this article for more details.

Existing clients on legacy Enhanced Payroll will continue to be supported with new pricing starting on Dec. 1, 2023.